A new enhancement in Keka’s US Payroll enables seamless management of tax documents for both employees and contractors. This feature improves compliance, enhances visibility, and reduces manual effort by offering a single place to access key tax forms like W-2, W-2c, 1099-NEC, and W-9.

What’s New?

-

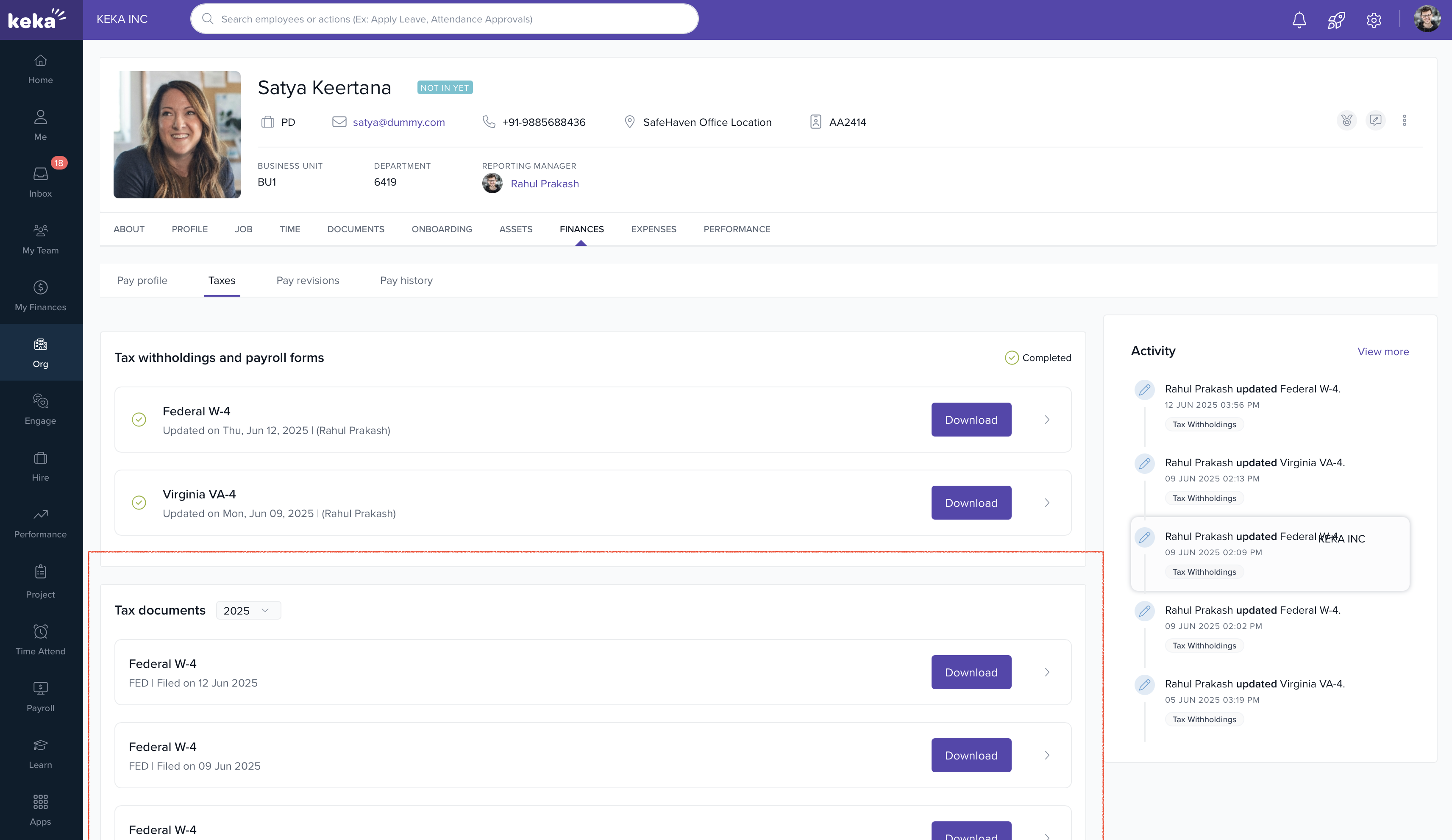

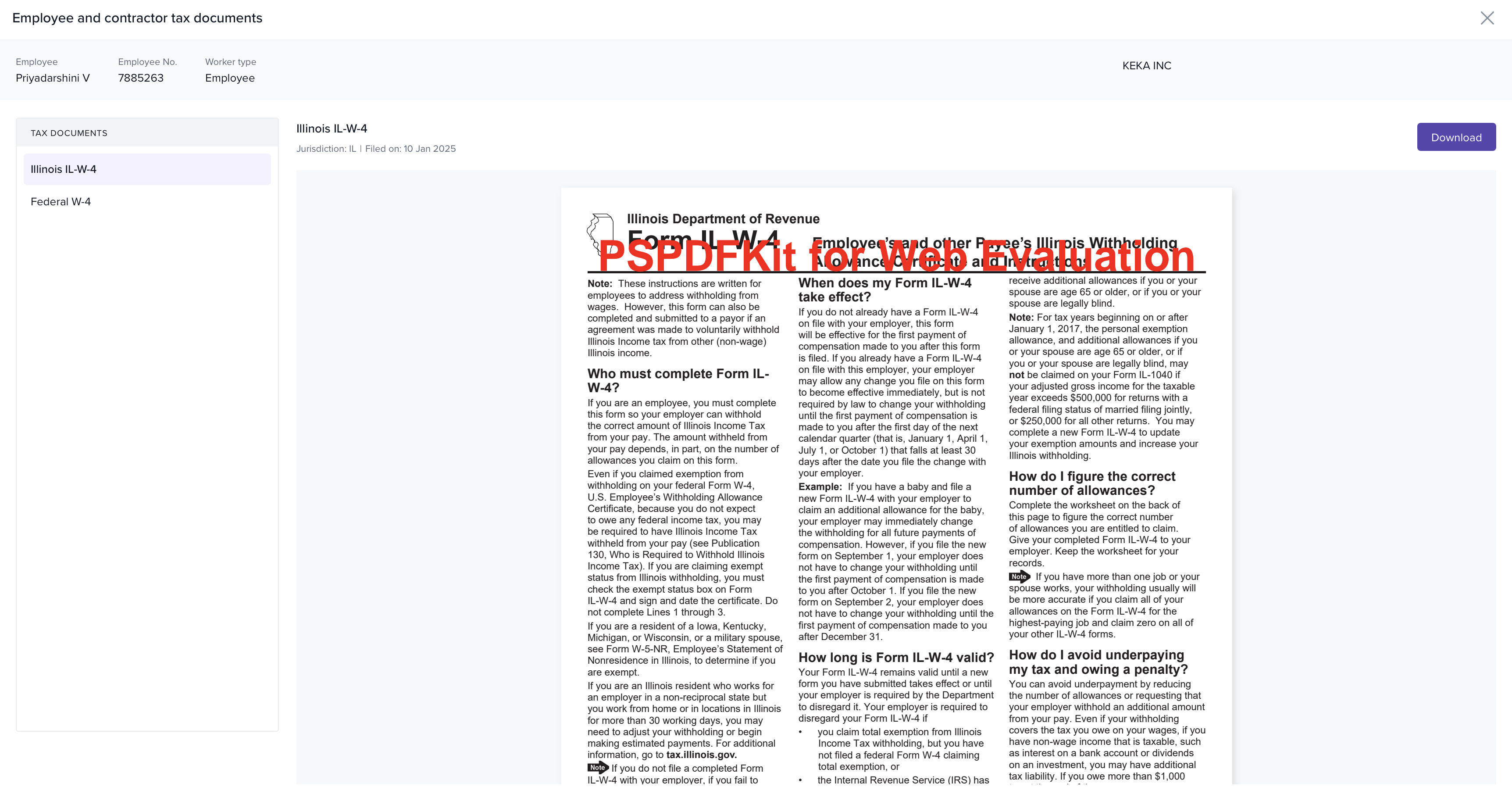

Tax Documents Tab under the Taxes section for employees and contractors to access their respective forms.

-

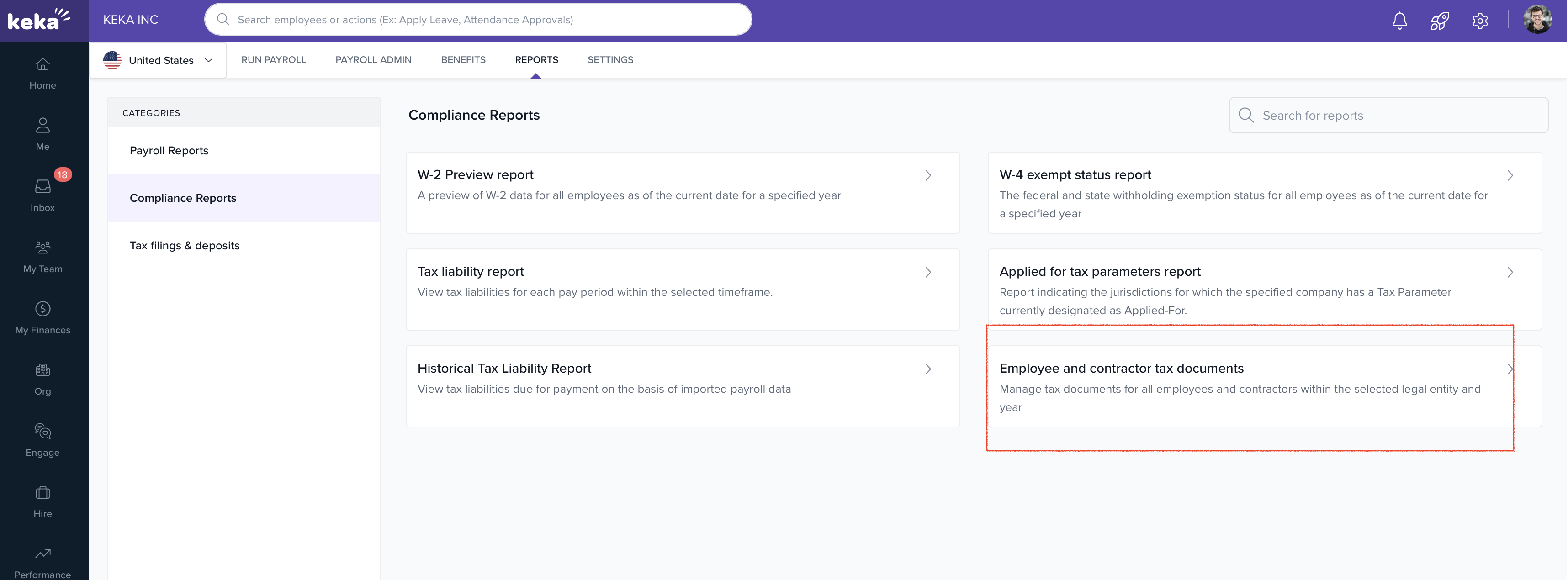

New Tax Documents Option in Compliance Reports for Admins to download documents for all users.

Why It Matters

-

W-2 is required for employee tax filing each year.

-

W-2c handles any necessary corrections.

-

1099-NEC is issued to contractors paid $600 or more annually.

-

W-9 ensures accurate tax information is collected from contractors.

The feature ensures smooth distribution of all required tax documents while helping meet IRS and state-level compliance standards.

Who Is It For?

-

Admins – Easily manage and access all employee and contractor tax forms in one place.

-

Employees & Contractors – Securely download required tax documents on time, directly from their portal.

Included in This Update

-

A dedicated ‘Tax Documents’ section under the Taxes tab for employees and contractors.

-

A new compliance report to manage and export tax forms for all users.

-

Supports W-2, W-2c, 1099-NEC, W-9, and state-level forms.

Simplified Year-End Compliance

This update ensures all tax documentation needs are met efficiently, securely, and in compliance with reporting regulations.

Related Documentation:

To know more about Tax Documents for Employees and Contractors (US Payroll) for admins, click on:

To know more about Tax Documents for Employees and Contractors (US Payroll), click on:

Please let us know if you find this article helpful.

Comments

0 comments

Please sign in to leave a comment.