Overview

This article provides a detailed explanation on how to add new tax rates as well as how to modify existing tax rates within your system. It covers the step-by-step process to ensure that you can efficiently manage tax settings, helping you keep your records accurate and compliant with current tax regulations.

Who Can Do This?

Pre-requisites

- You must have billing privileges in the Keka PSA Finance section

- Legal entities must be configured in the system

- Ensure that tax rates are not already applied to existing invoices if you intend to delete or modify them

Why Are Tax Rates Important?

- Tax rates ensure legal compliance with regional and international tax regulations

- Applicable tax may vary based on business location, service type, or customer segment

- For example, India uses GST, a combination of Central and State tax components that must be managed accurately

Benefits of Keka PSA Tax Management

- Simplified Compliance: Configure tax rates to meet country-specific invoicing rules

- Flexible Configuration: Add or group tax types as per business needs

- Streamlined Invoicing: Automatically apply correct tax values while generating project invoices

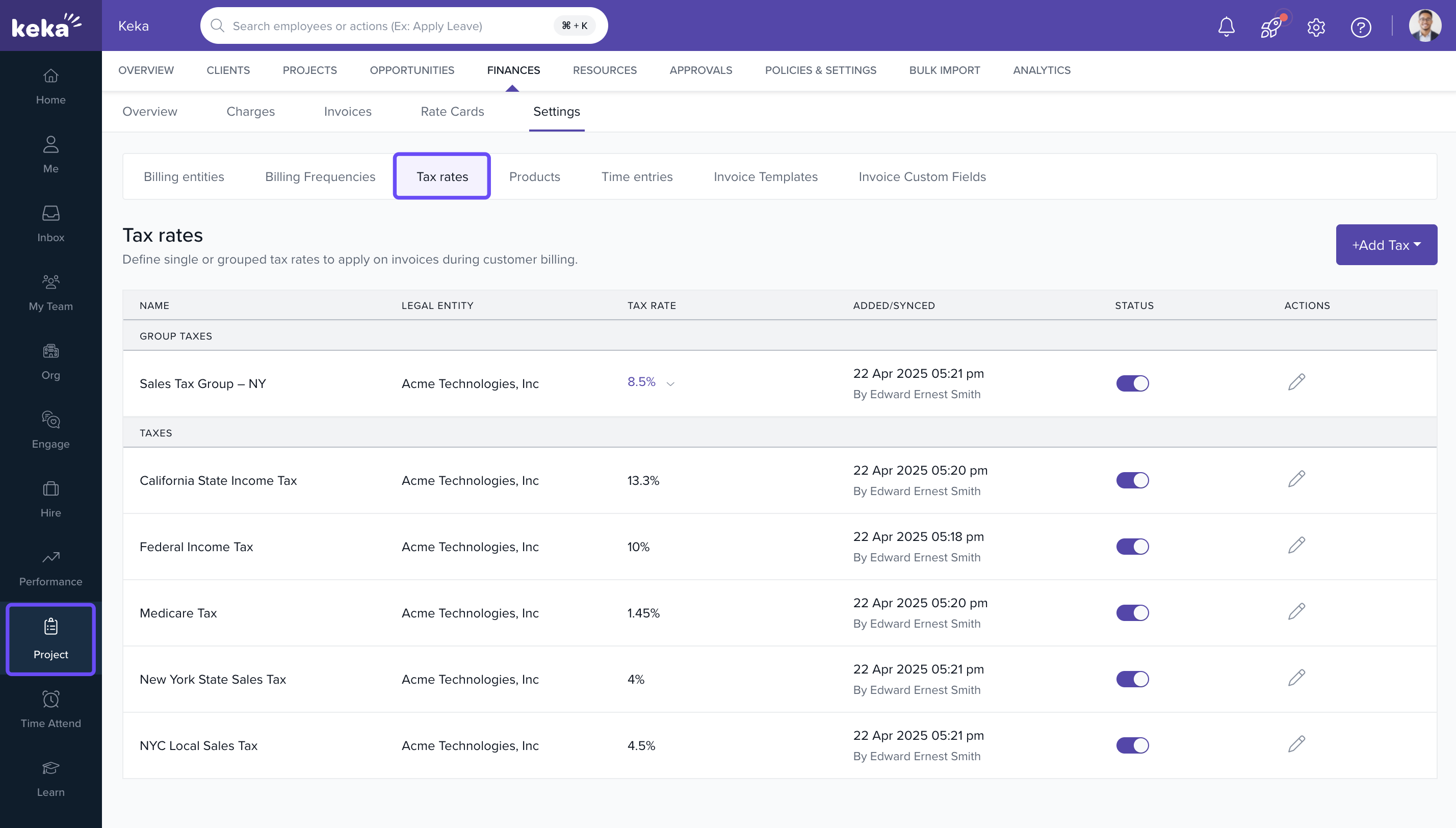

Accessing the Tax Management Section

- Go to the Projects section

- Navigate to the Finance tab

- Click on Settings

- Select Taxes to view and manage tax configurations

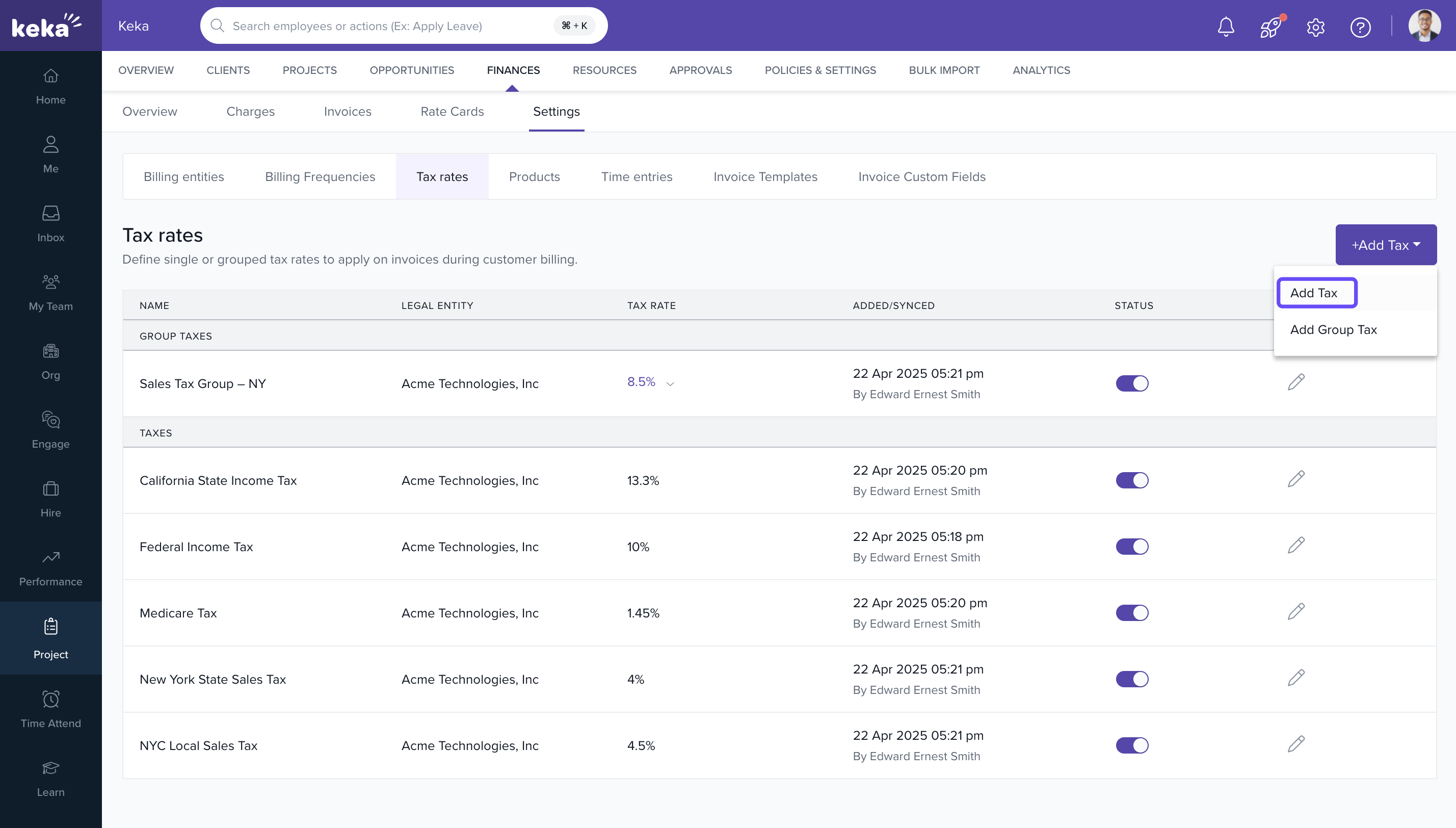

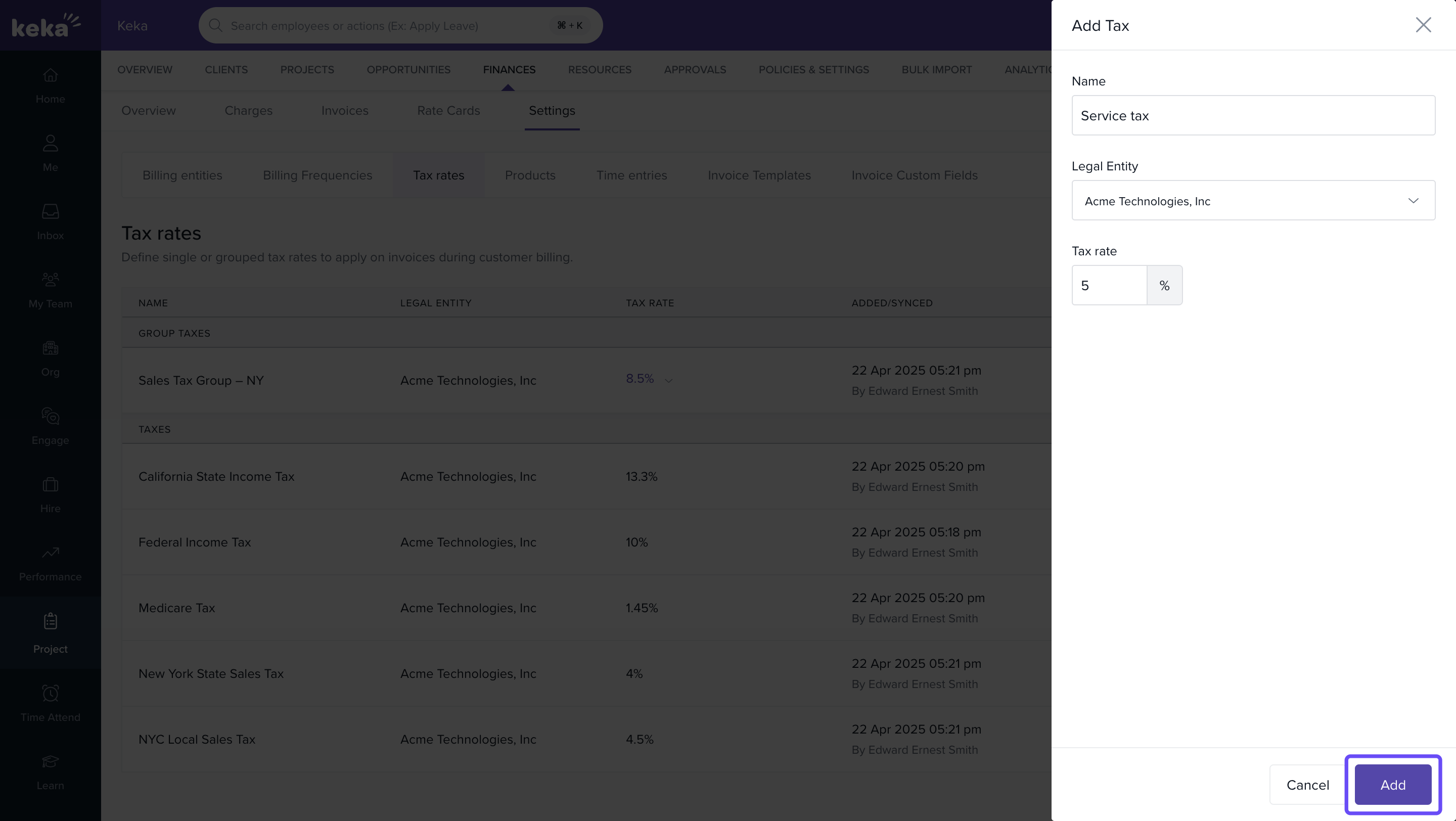

Adding an Individual Tax Rate

- Click on the +Add Tax button

- Select Add Tax from the dropdown

- In the Add Tax window, fill in the following:

- Name: Example – Service Tax

- Legal Entity: Choose from your configured legal entities

- Tax Rate (%): Input the tax percentage (e.g., 18%)

- Click Add to save

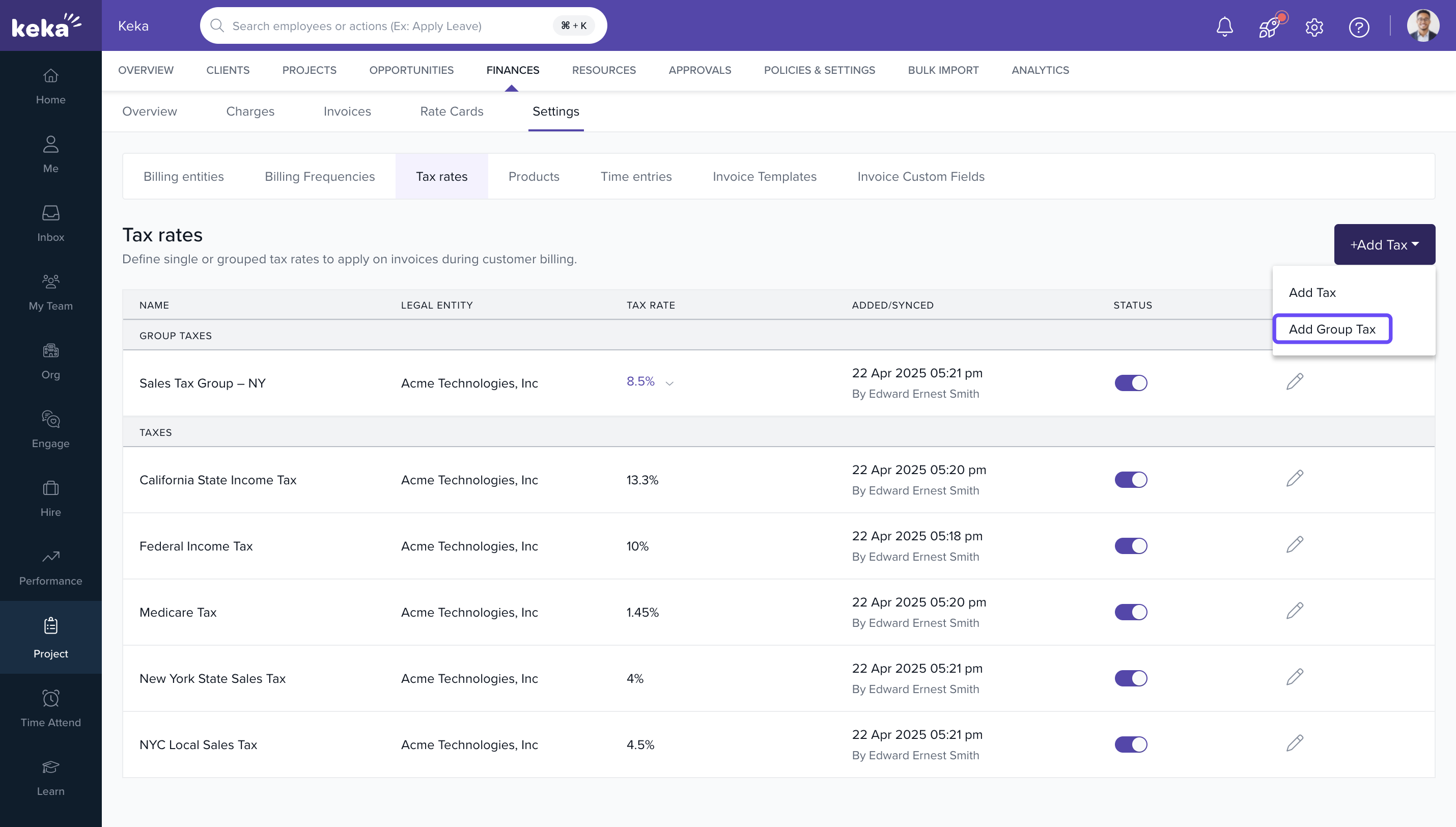

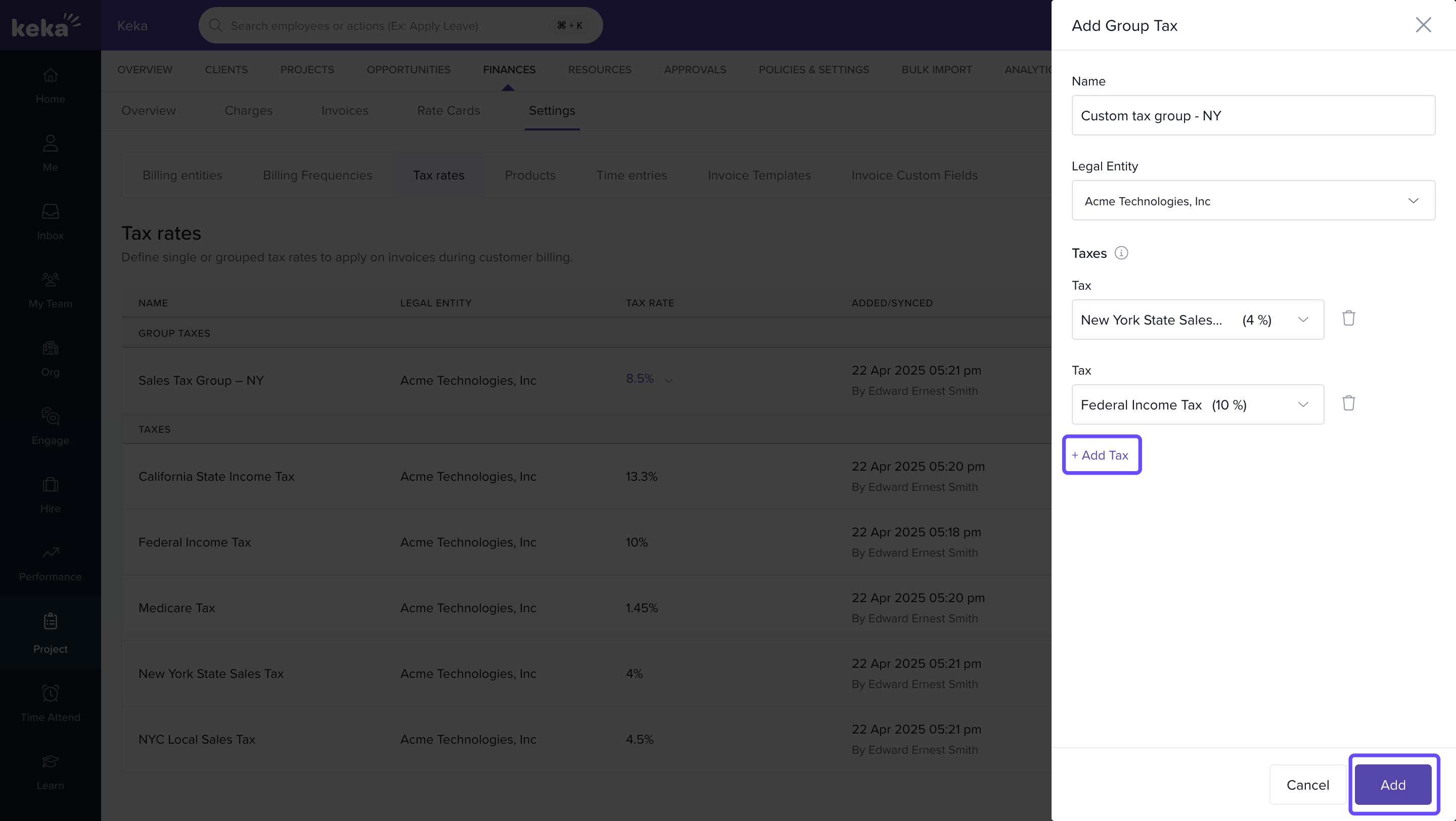

Adding a Group Tax Rate

- Click on the +Add Tax button

- Select Add Group Tax

- In the Add Group Tax window:

- Enter Name for the group (e.g., GST India)

- Select the Legal Entity

- Under Taxes, choose individual taxes to group or click +Add New Tax to create new ones

- Click Add to save the group tax rate

Note: Group taxes are especially useful in countries like India where multiple tax components apply

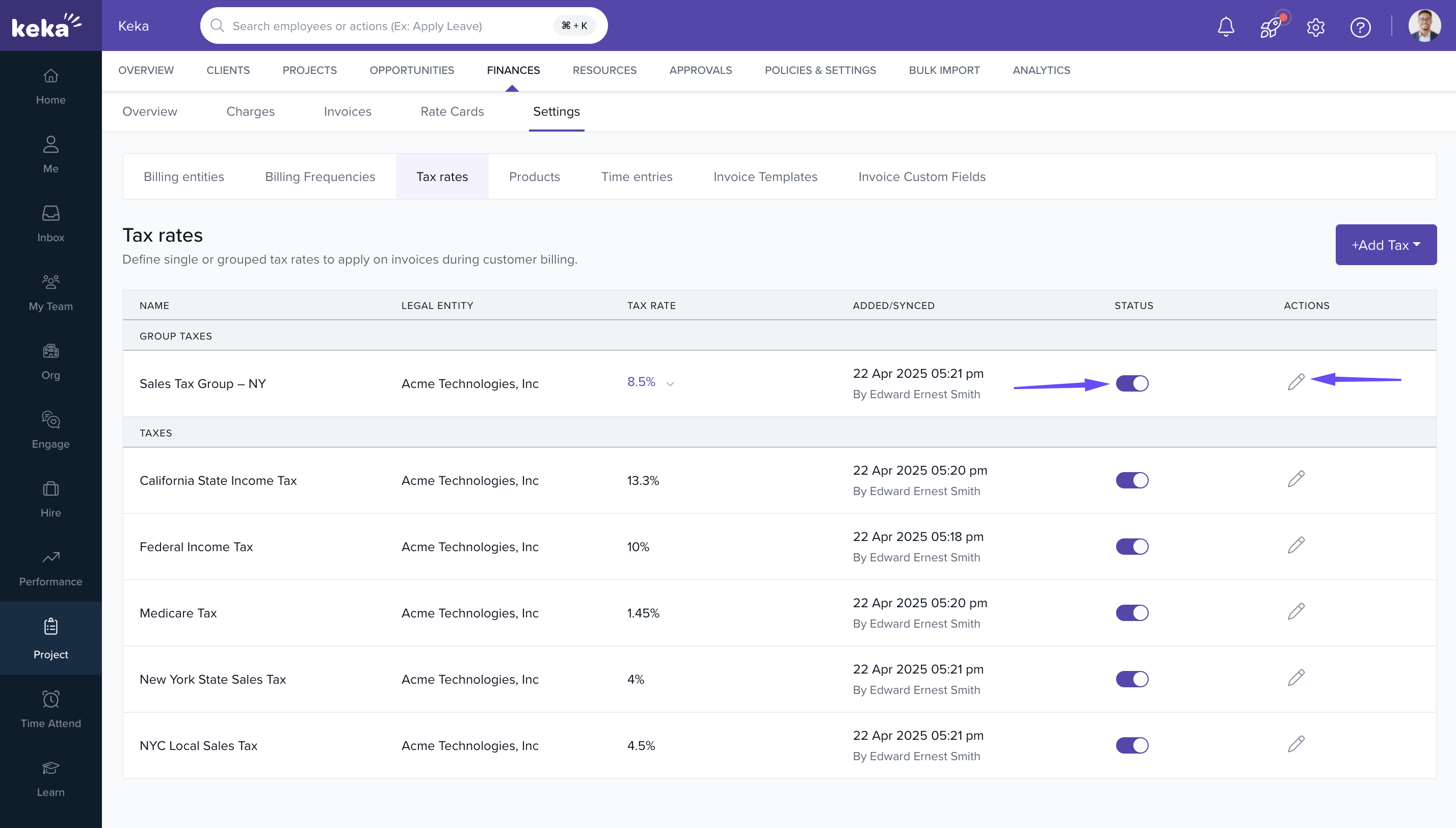

Managing Existing Tax Rates

- On the Tax Rates page, view all configured tax rates

- Use the toggle button in the Status column to enable or disable taxes

- Click the Edit icon in the Actions column to update rate name or percentage

- To delete a tax rate, ensure it is not applied to any timesheets or invoices and then click Delete from the action menu

Note: Disabled taxes will not be available while invoicing

FAQs

Q: Can I apply multiple taxes to the same invoice?

A: Yes. Use the Group Tax feature to combine multiple individual taxes into a single line item

Q: What happens if I disable a tax rate?

A: It won’t be available for future use but will still appear on past invoices for audit consistency

Q: Can I delete a tax rate that’s in use?

A: No. You must first remove it from all associated records

Q: Are taxes automatically applied based on project location?

A: No. Taxes must be manually selected or configured per client/project

Q- If a tax is edited, will it affect the past invoices as well?

A- no. Only future invoices

Comments

0 comments

Please sign in to leave a comment.