Introduction

Piece-Based Remuneration is a flexible payroll model that allows organizations to pay employees based on the number of units, sessions, or tasks completed—rather than a fixed monthly or daily wage.

Keka supports Piece-Based Remuneration with end-to-end configuration options, tax setup, and payroll processing workflows. This article walks you through the key configurations and usage steps.

Only users with Admin or Payroll Owner roles who have access to Pay Groups, Payroll Settings, and Employee Compensation can set up and manage Piece-Based Remuneration in Keka.

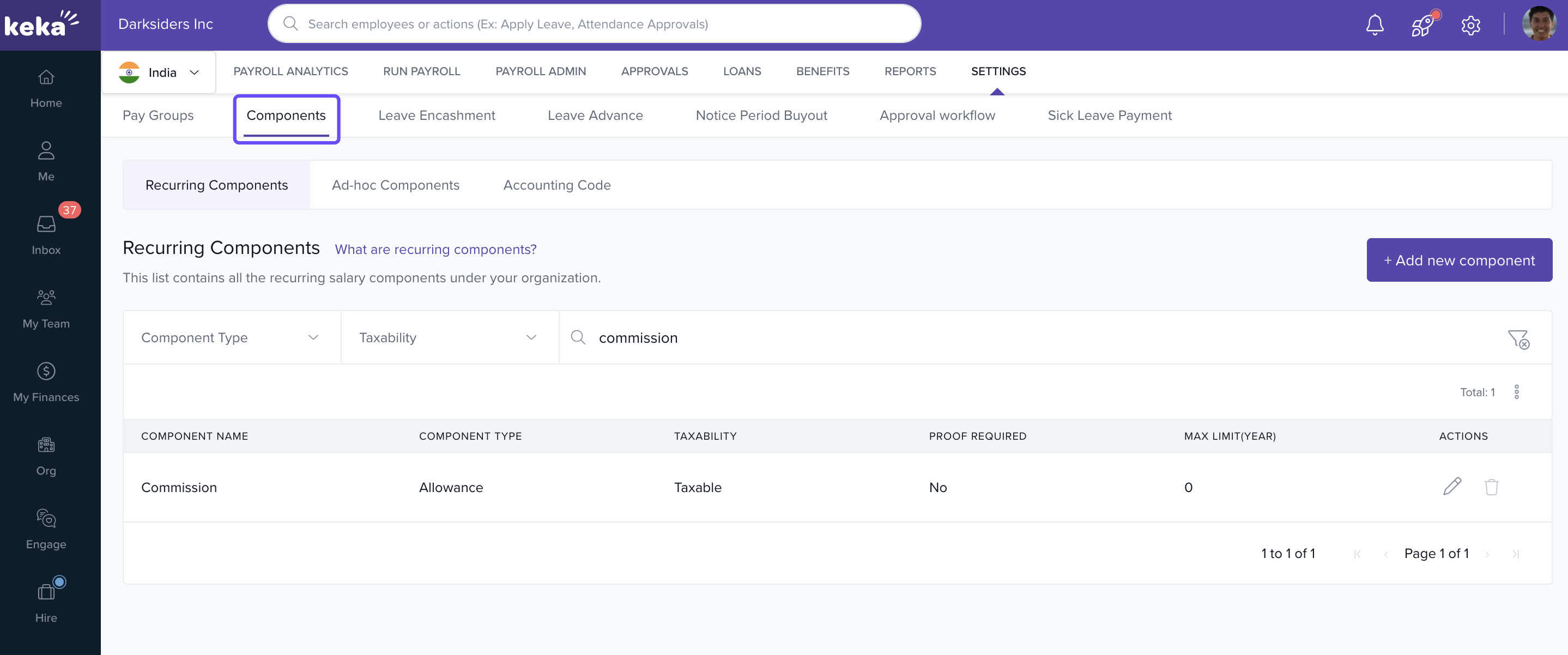

Add the Default Component - Commission

Keka automatically adds a default component named Commission for use in Piece-Based Remuneration.

Component Name: Commission

Component Type: Allowance

Help Text: Commission is generally paid to contract employees for the professional services they render over a specific period.

Frequency: Recurring

Taxability: Taxable

Max Limit: Not Applicable

Arrears: Include in arrear calculation

Other Settings: All others are disabled by default

Enable Piece-Based Remuneration in a Pay Group

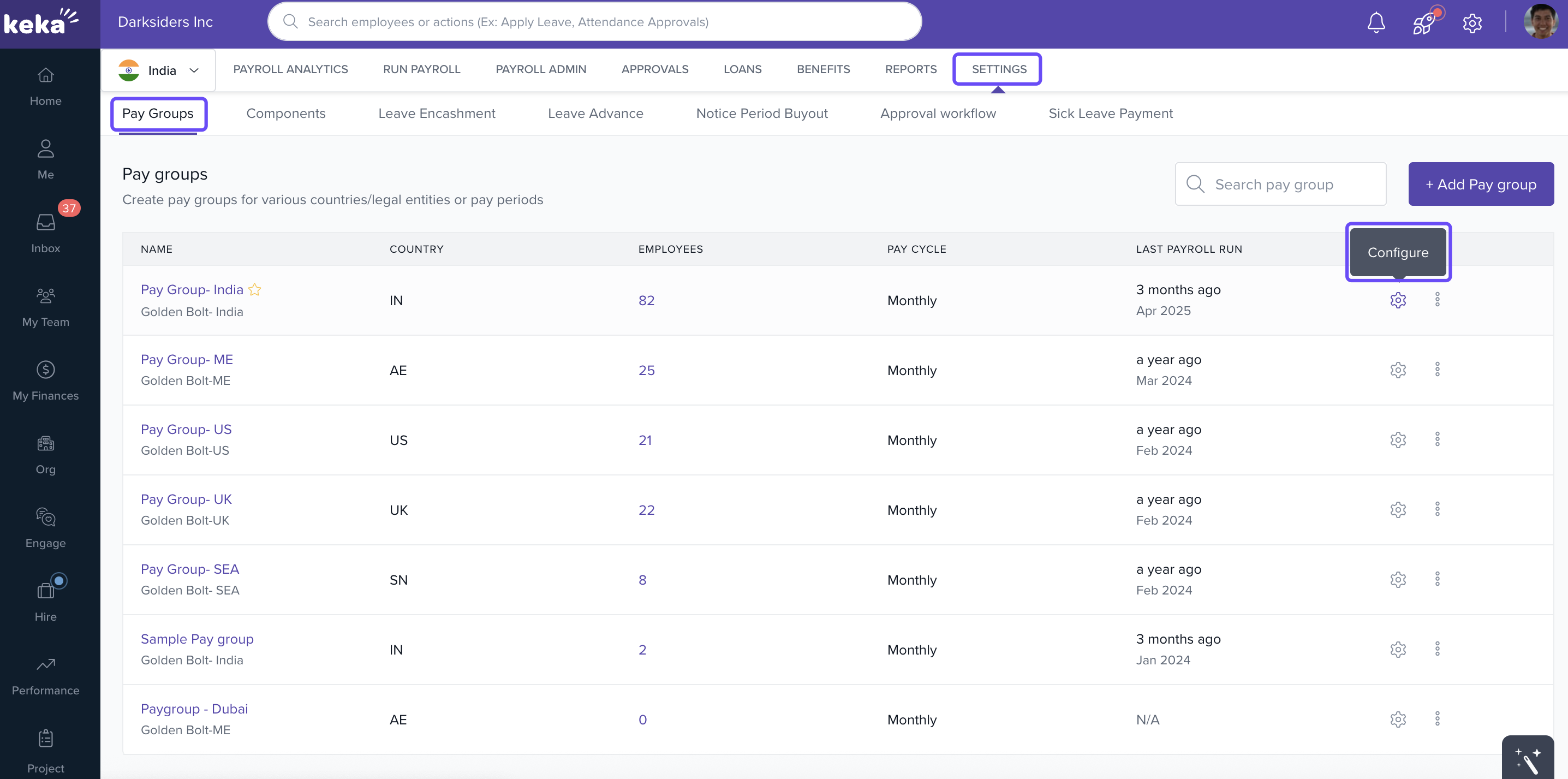

Go to Payroll → Settings.

Select the Pay Group you want to enable Piece‑Based Remuneration for, and click Configure.

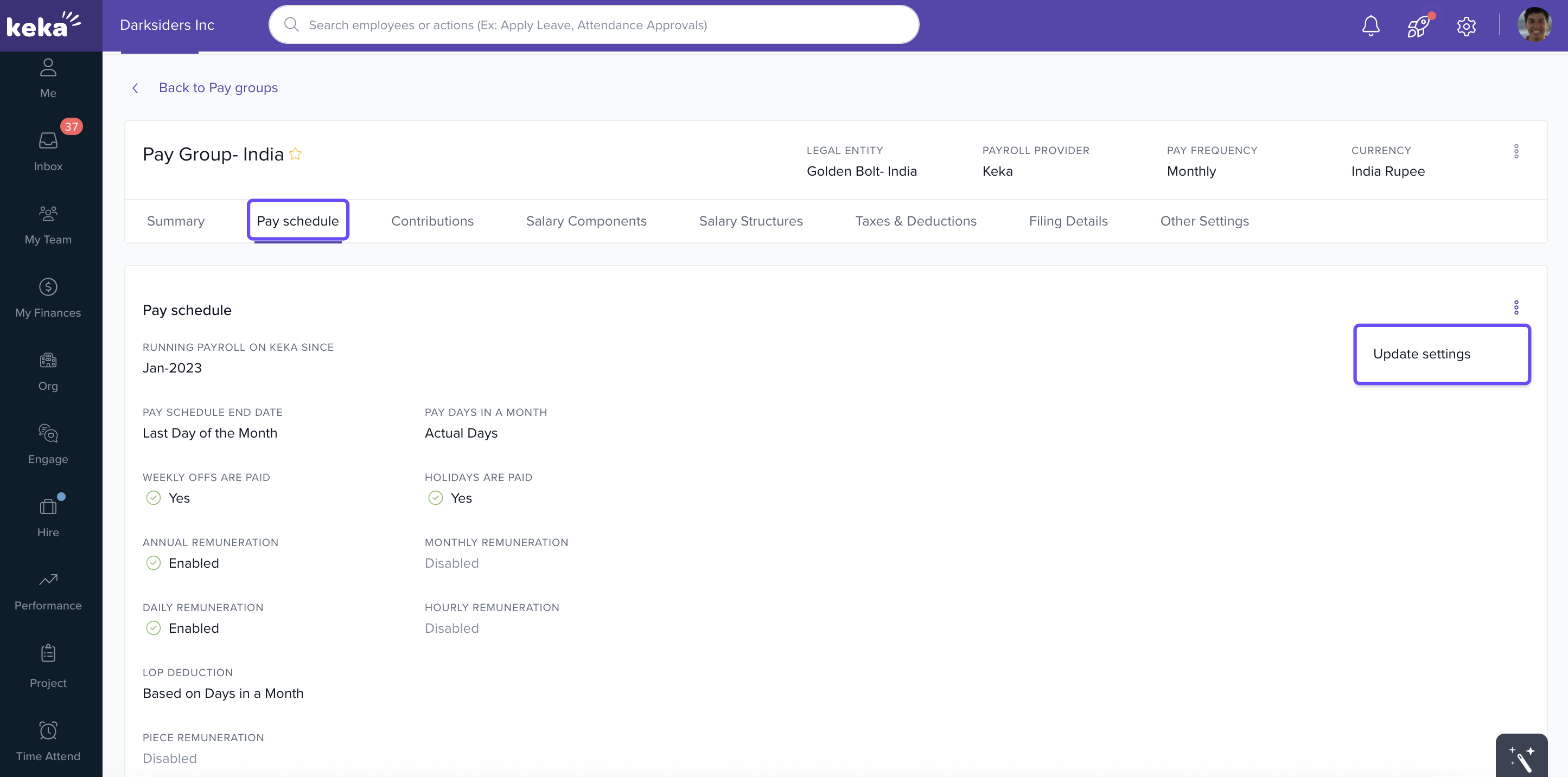

3. Click the three dots next to pay schedule and select Update setting.

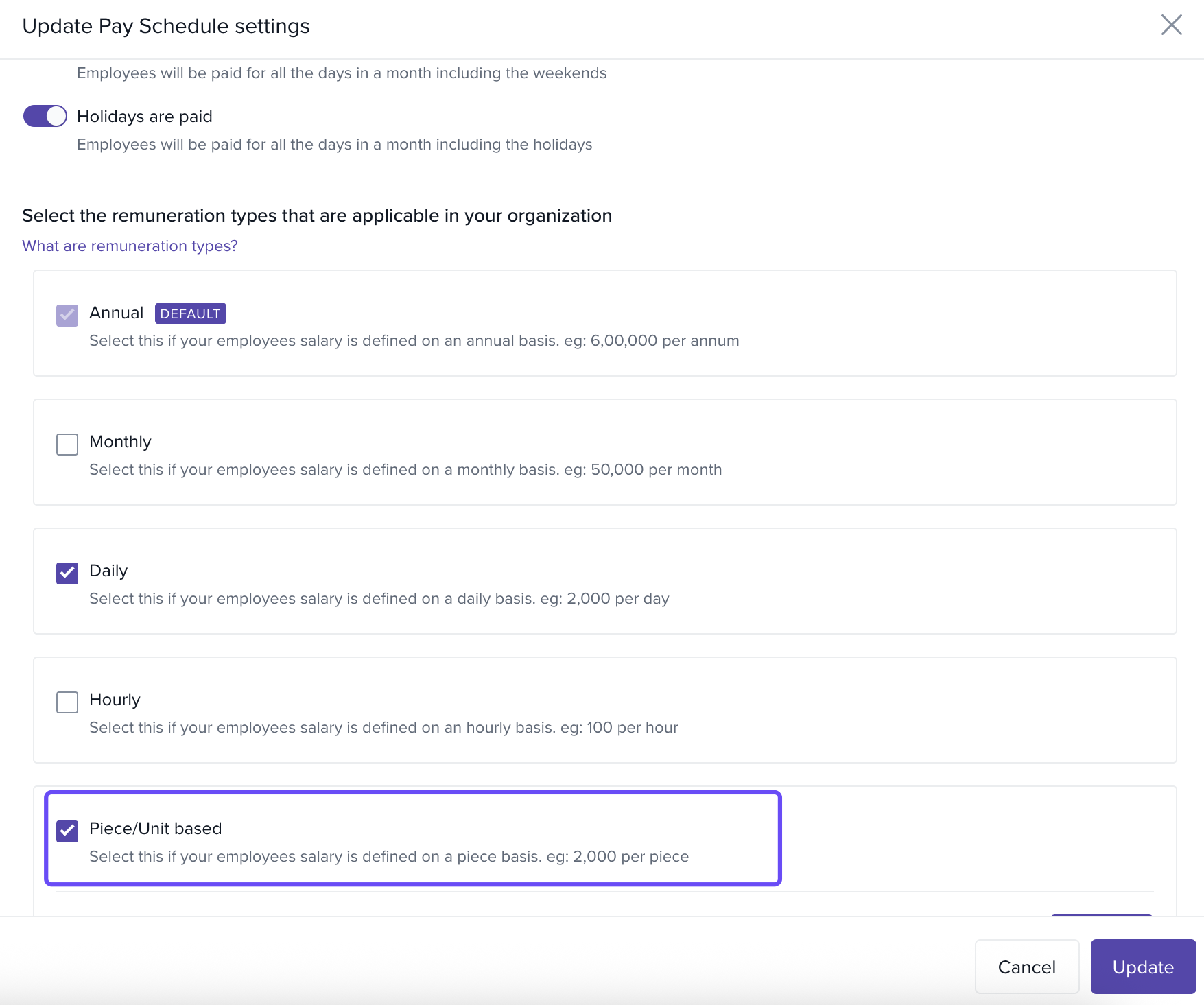

4. Enable Piece‑Based Remuneration under the Update Pay Schedule Settings section.

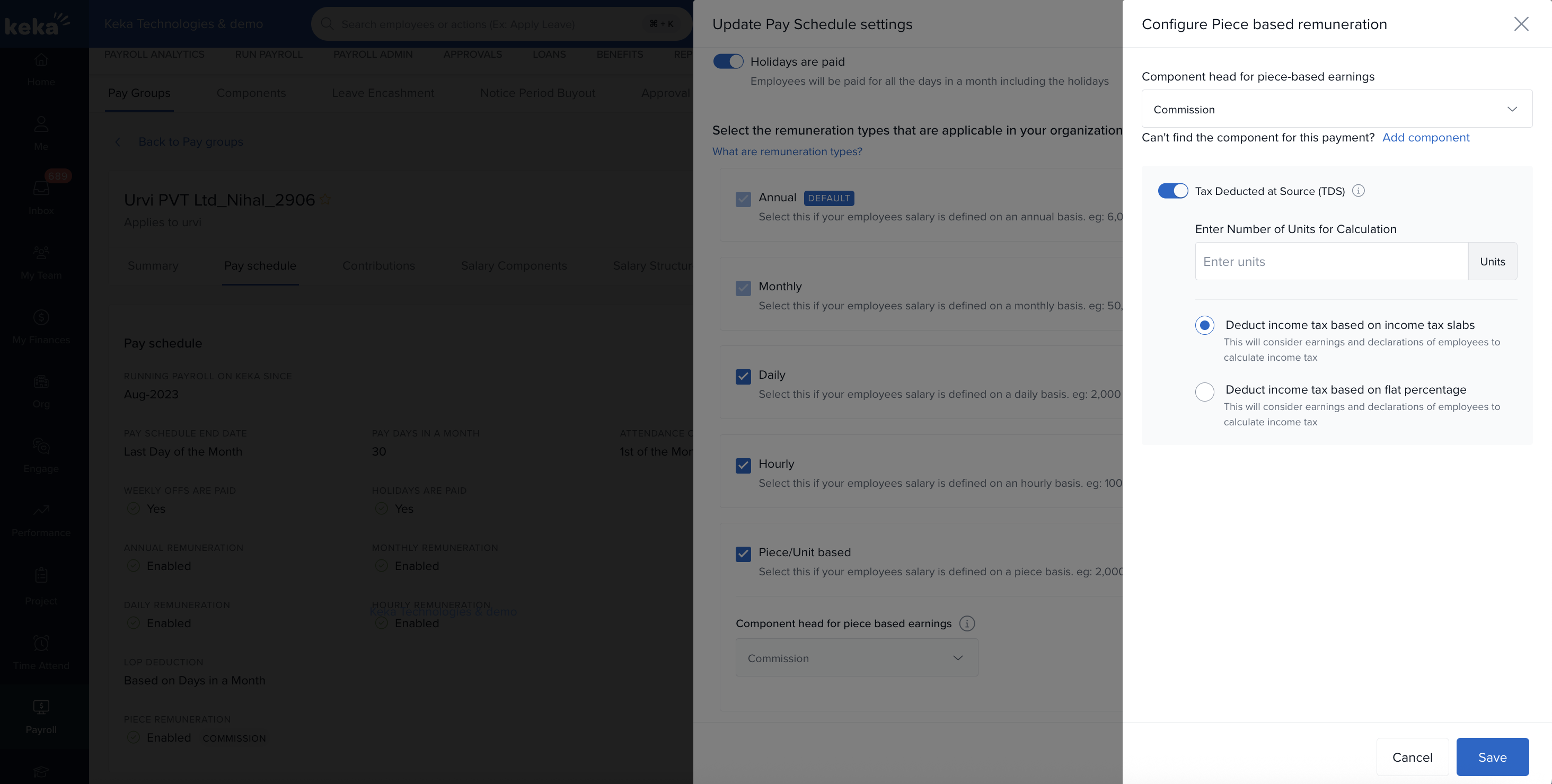

Configure TDS for Piece-Based Employees

Once Piece-Based Remuneration is enabled, you’ll see TDS configuration options:

Enable or disable TDS for the employees.

-

If enabled, configure:

Default units for tax projection

-

Calculation method:

Slab-based

Formula-based (with formula setup option)

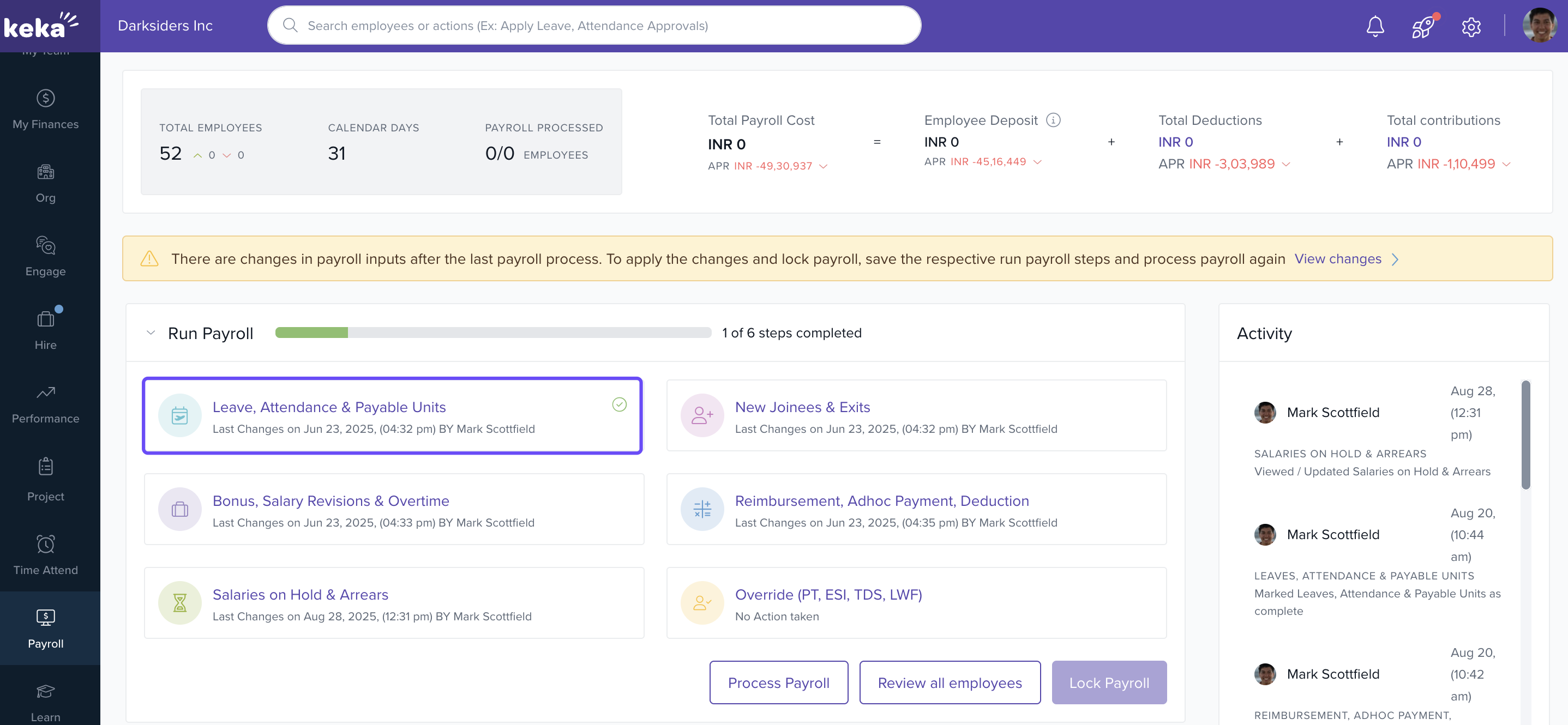

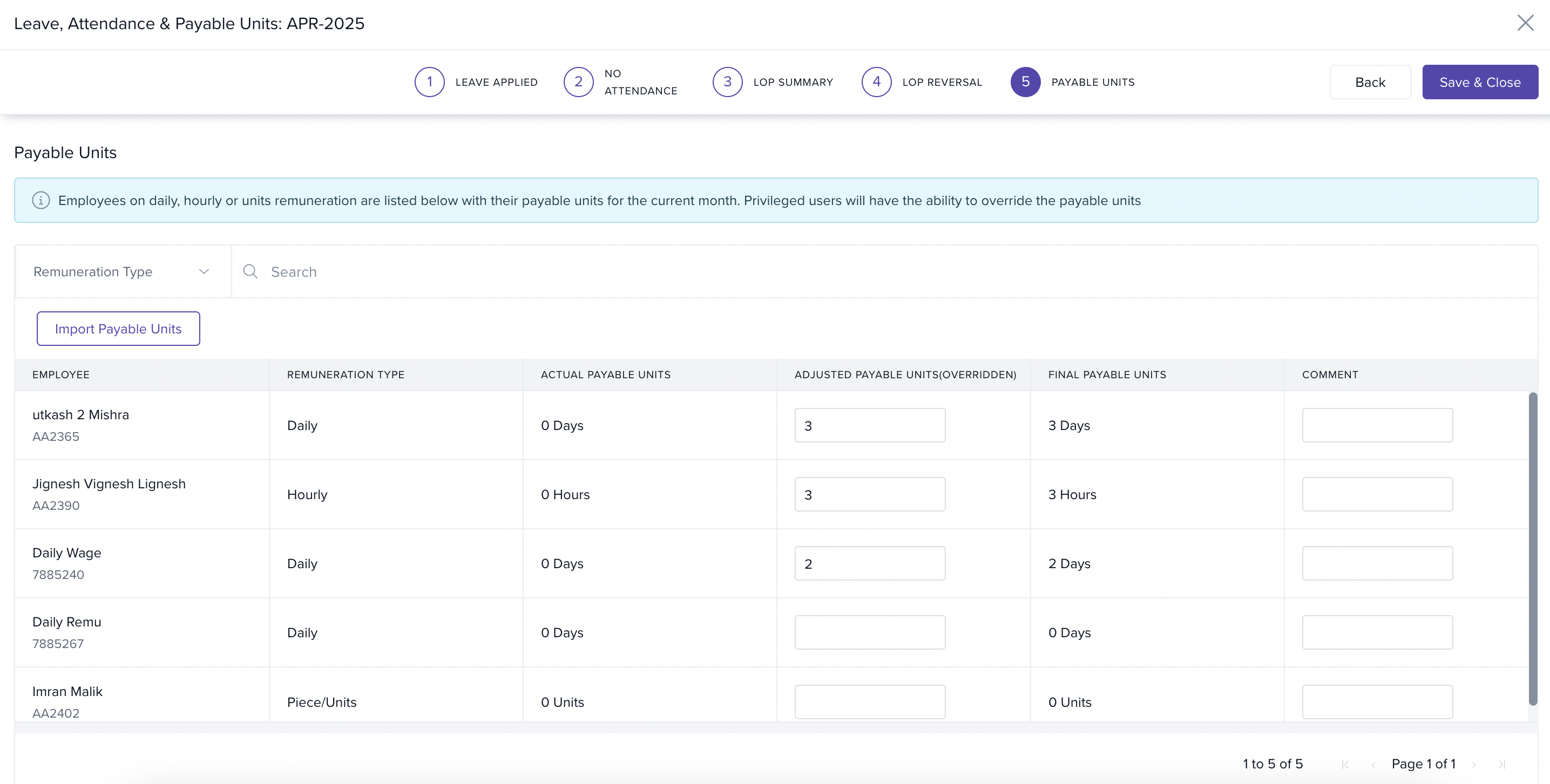

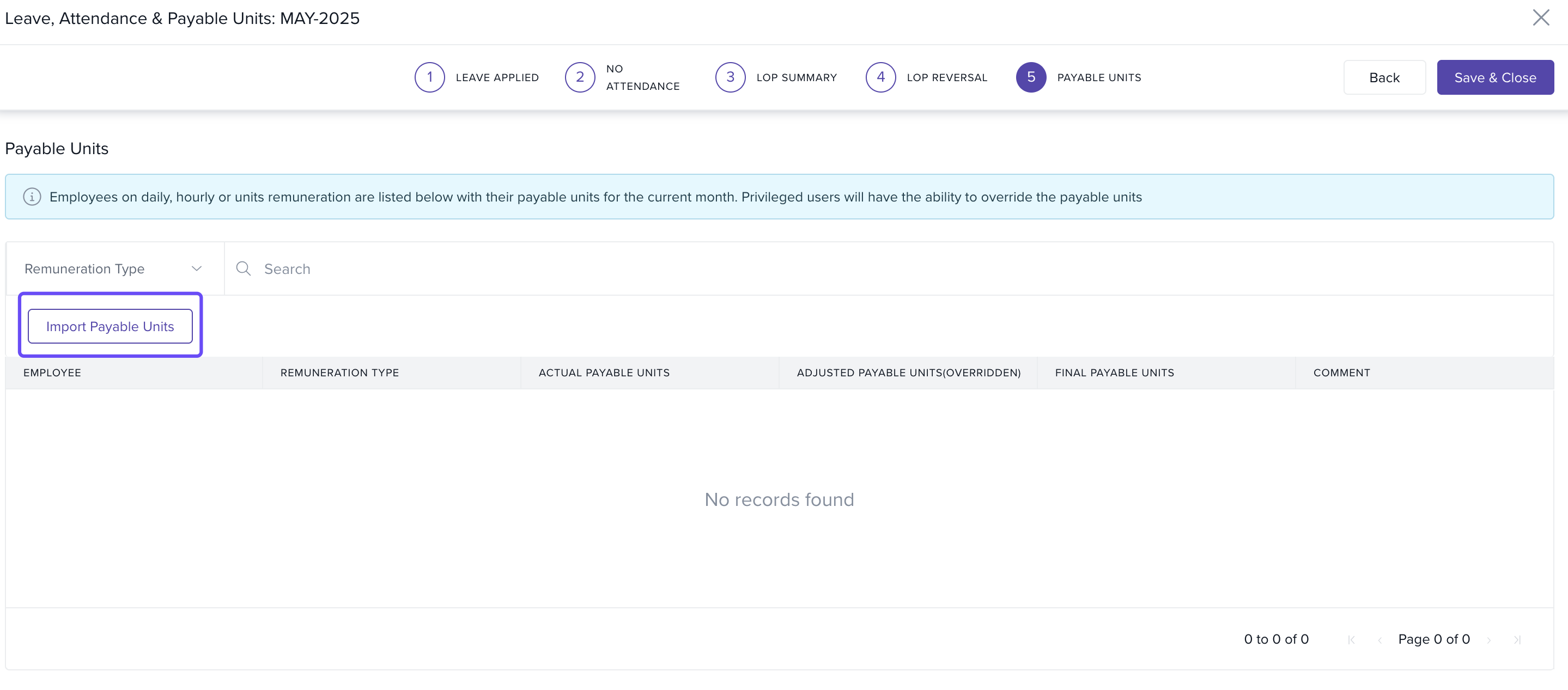

Process Payroll for Piece-Based Employees

- Go to Run Payroll.

- You’ll find Payable Units listed as the fifth option on the payroll page.

- Adjust their payable units as needed and click Save to apply the changes.

- You can also import Payable Units in bulk by clicking the Import Payable Units option

Piece-Based Remuneration in Keka enables organizations to support flexible, output-driven pay models suited for retail, training, manufacturing, and gig-based workforces. With robust configuration, tax settings, and payroll handling, this model promotes transparency and adaptability in compensation practices.

Comments

0 comments

Please sign in to leave a comment.