Introduction

Employee salaries often include multiple components. Some are recurring, like Basic or HRA, while others are ad-hoc, such as a Joining Bonus or Salary Advance Recovery.

Keka lets you create, manage, and customize salary components to suit your organization’s payroll policies. This article explains how to:

-

Add new salary components

-

Make components available to specific pay groups

-

Understand recurring vs. ad-hoc components

Process Overview

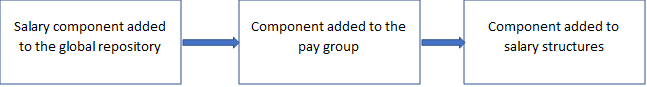

Salary components in Keka follow a structured flow:

-

Add the component to the global repository.

-

Assign it to a pay group.

-

Include it in the salary structures you create for employees in that pay group.

Adding a Salary Component to the Global Repository

There are two types of salary components you can create in Keka:

Recurring Components

-

Paid to employees in every pay cycle.

-

Independent of performance or other conditions.

-

Examples: Basic, HRA, Dearness Allowance.

-

May be taxable or partially exempt based on Income Tax regulations.

Note: Some recurring components are mandatory and predefined by the system. These cannot be edited and are marked with a lock icon.

Ad-hoc Components

-

Added or deducted as needed, not part of regular salary.

-

Useful for one-time payments or recoveries.

-

Examples: Joining Bonus, Referral Bonus, Salary Advance Recovery, Asset Damage Recovery.

Notes & Tips

Note: Always add new components to the global repository first, before linking them to pay groups.

Tip: Use recurring components for consistent, monthly pay items, and ad-hoc components for one-off adjustments.

Examples

-

Recurring scenario: An employee’s salary includes Basic, HRA, and Dearness Allowance every month.

-

Ad-hoc scenario: An employee receives a one-time Joining Bonus or has Salary Advance Recovery deducted.

Compliance

Recurring salary components may be subject to Income Tax laws. Some are fully taxable, while others may be exempt up to specified limits. Always configure them in line with current regulations.

We hope this article has equipped you with the information needed to manage salary components confidently in Keka.

Comments

0 comments

Please sign in to leave a comment.