Introduction

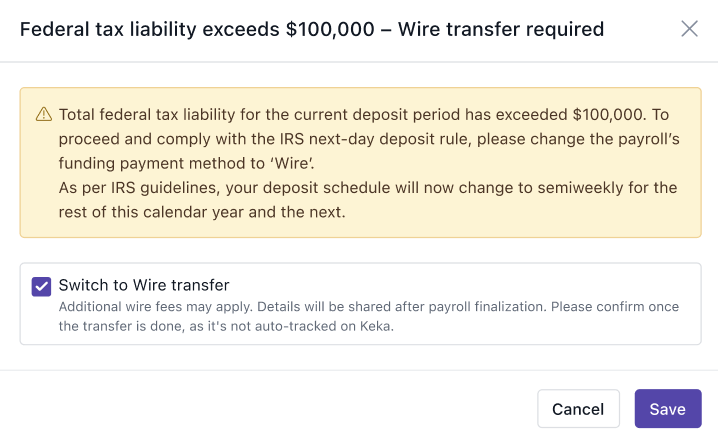

If your company’s federal tax liability hits $100,000 or more in a single deposit period, the IRS requires you to make a next-day tax deposit. This article explains what this rule means, when it applies, and how Keka ensures your business remains compliant by requiring wire transfers for high-value tax deposits.

- Who this is for: Payroll admins and finance teams using Keka

- Why it matters: Avoid IRS penalties and ensure employees are paid on time

What Happens When You Cross the $100K Threshold

-

The IRS mandates that if your federal tax liability reaches $100,000 or more on any single day, you must deposit the taxes by the next business day, regardless of your usual deposit schedule.

-

Once this happens, the IRS automatically switches your deposit schedule to semiweekly for the rest of the current calendar year and the entire next year.

This liability includes:

-

Federal income tax withholding

-

Employer and employee portions of Social Security and Medicare (FICA)

Why Wire Payments Are Required

Most employers use ACH (Automated Clearing House) transfers for tax payments, which typically take up to 3 business days to process. That’s too slow to meet the IRS’s next-day deposit rule.

If you continue using ACH:

-

Keka will block payroll approval

-

Employee payments may be delayed

-

Your company could face IRS penalties and interest

Switching to wire transfer ensures same-day processing, helping you meet IRS deadlines and avoid disruptions.

When This Rule Might Apply

You’re more likely to cross the $100K threshold if:

-

You run an off-cycle payroll for large bonuses or exit settlements

-

You have 20 or more employees with mid-to-high salaries

-

You have fewer employees but with very high wages

Example:

-

Total payroll: $400,000

-

Estimated federal tax liability (~37.3%): $149,200

Since this exceeds $100K, wire payment is required to stay compliant.

Key Implications

-

Keka already defaults to a semiweekly deposit schedule.

-

If your payroll triggers the $100K rule:

-

Payroll approval will be blocked until the required tax deposit is made via wire transfer.

-

Admins will be prompted to update the payment method in Keka.

-

Continuing to use ACH after reaching $100,000 in tax liability may lead to payroll delays and IRS penalties. Always switch to wire payments when prompted.

Comments

0 comments

Please sign in to leave a comment.