The DIFC Employee Workplace Savings (DEWS) plan is a statutory requirement for entities operating in the DIFC Free Zone. It replaces traditional end-of-service benefits with employer-funded contributions and allows employees to make voluntary contributions.

Keka enables you to configure, manage, and process DEWS contributions directly within payroll, ensuring compliance and ease of administration.

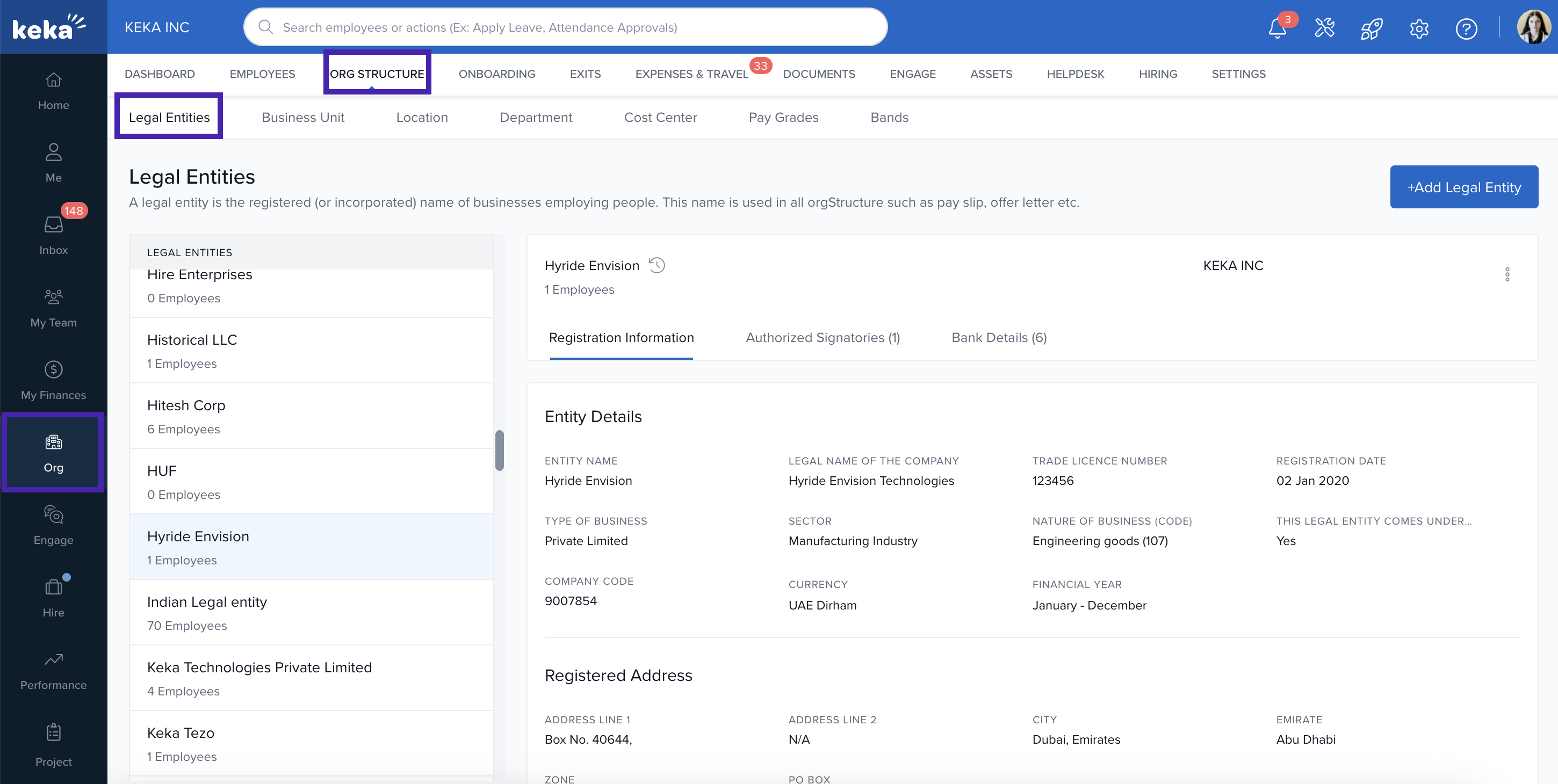

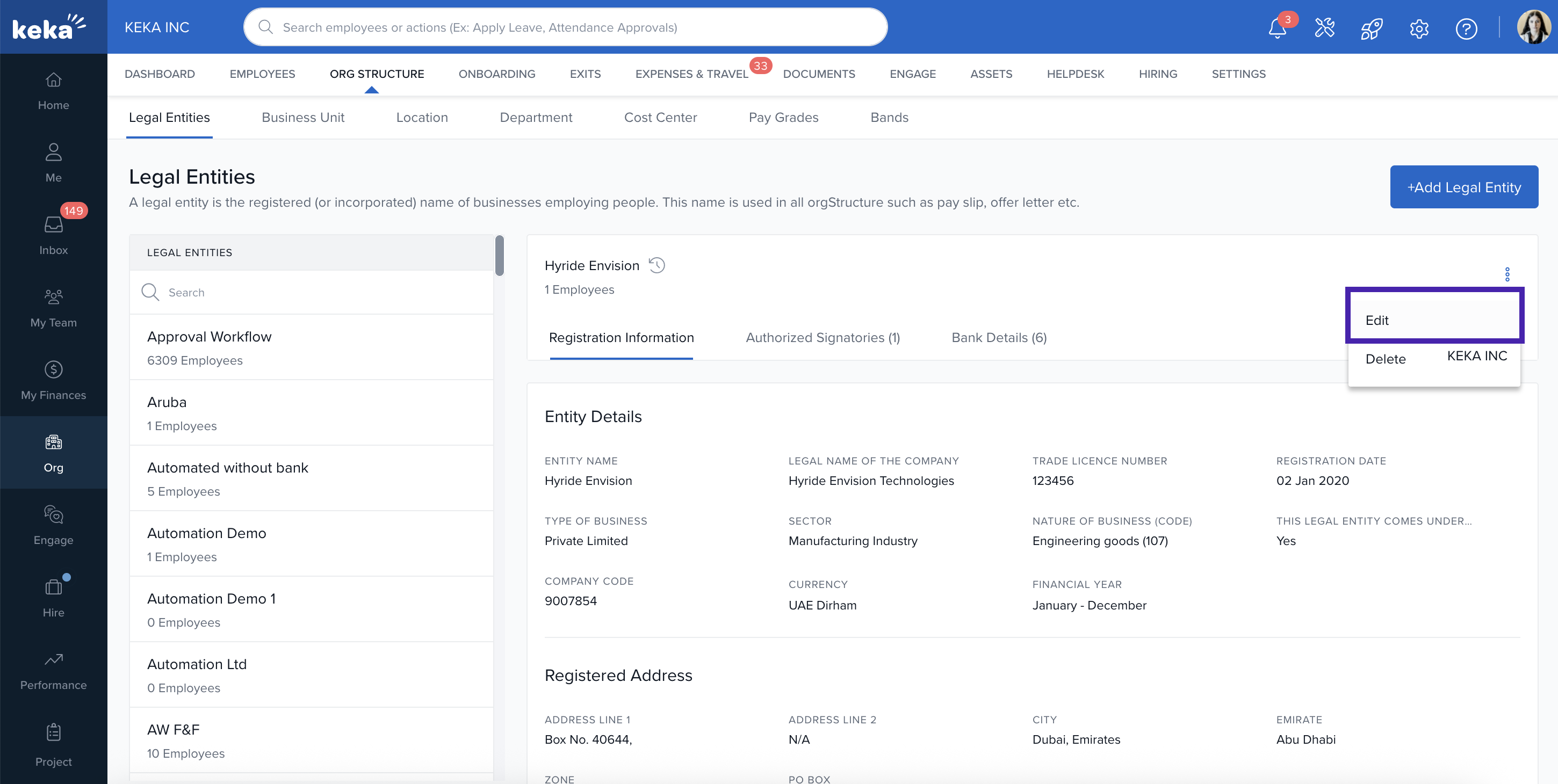

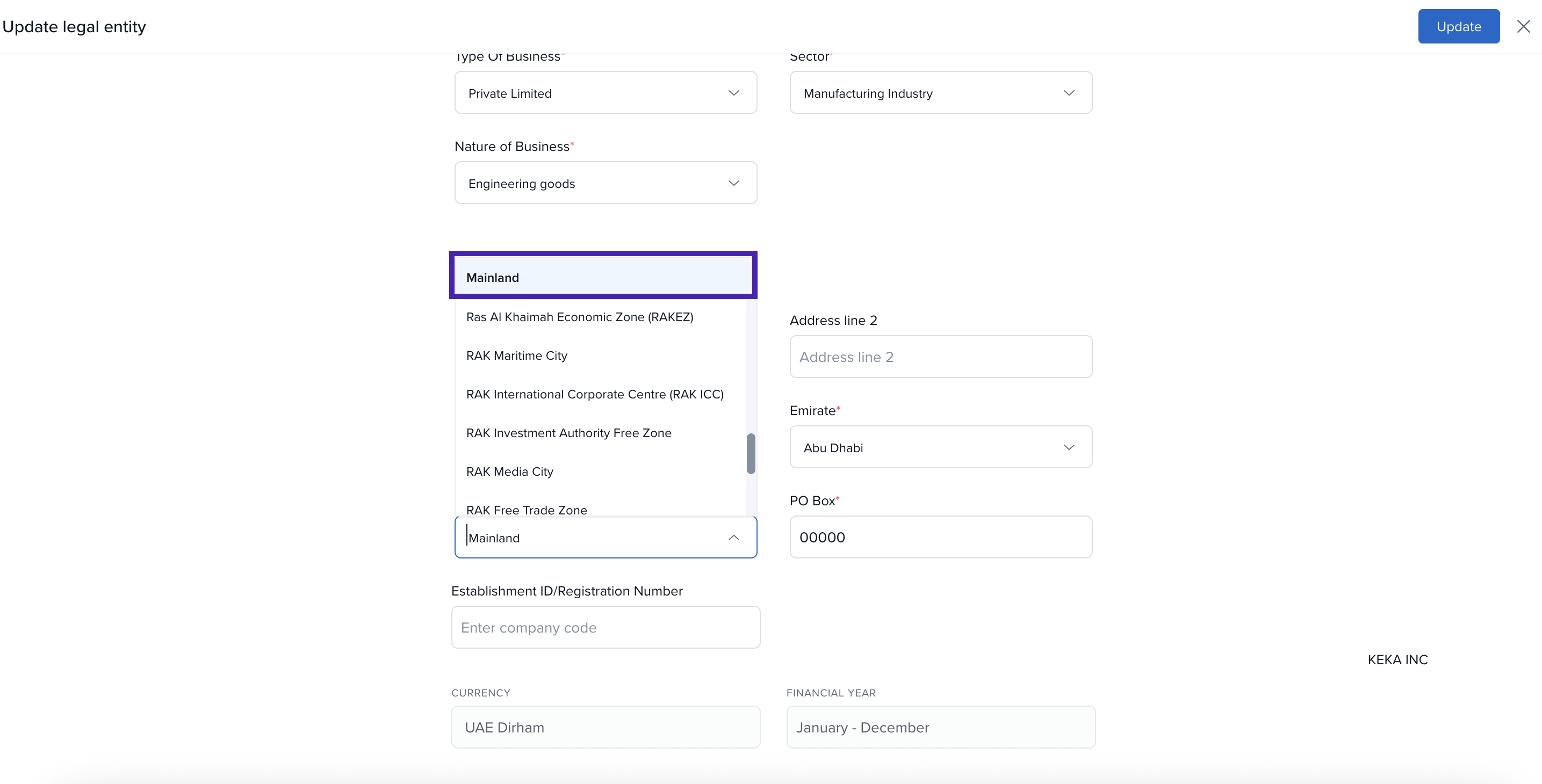

To configure the legal entity zone, navigate to Organisation, open Org Structure, and then select Legal Entity to update the zone settings.

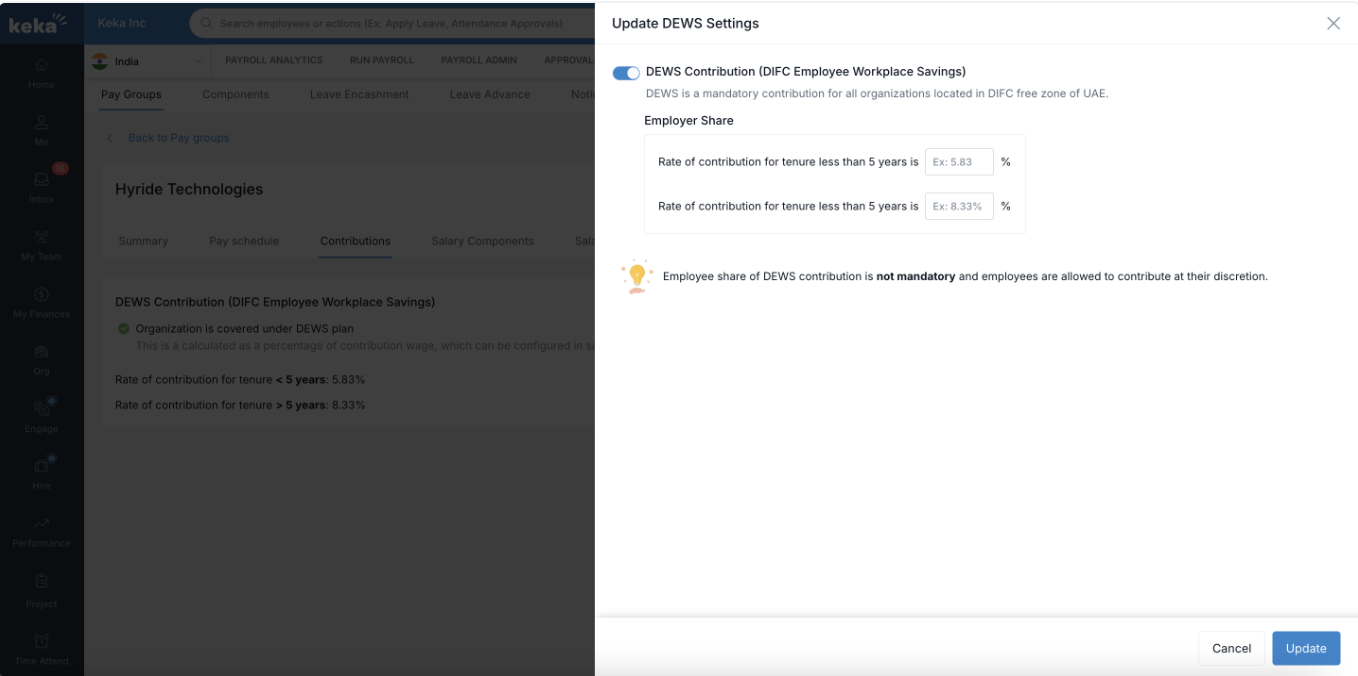

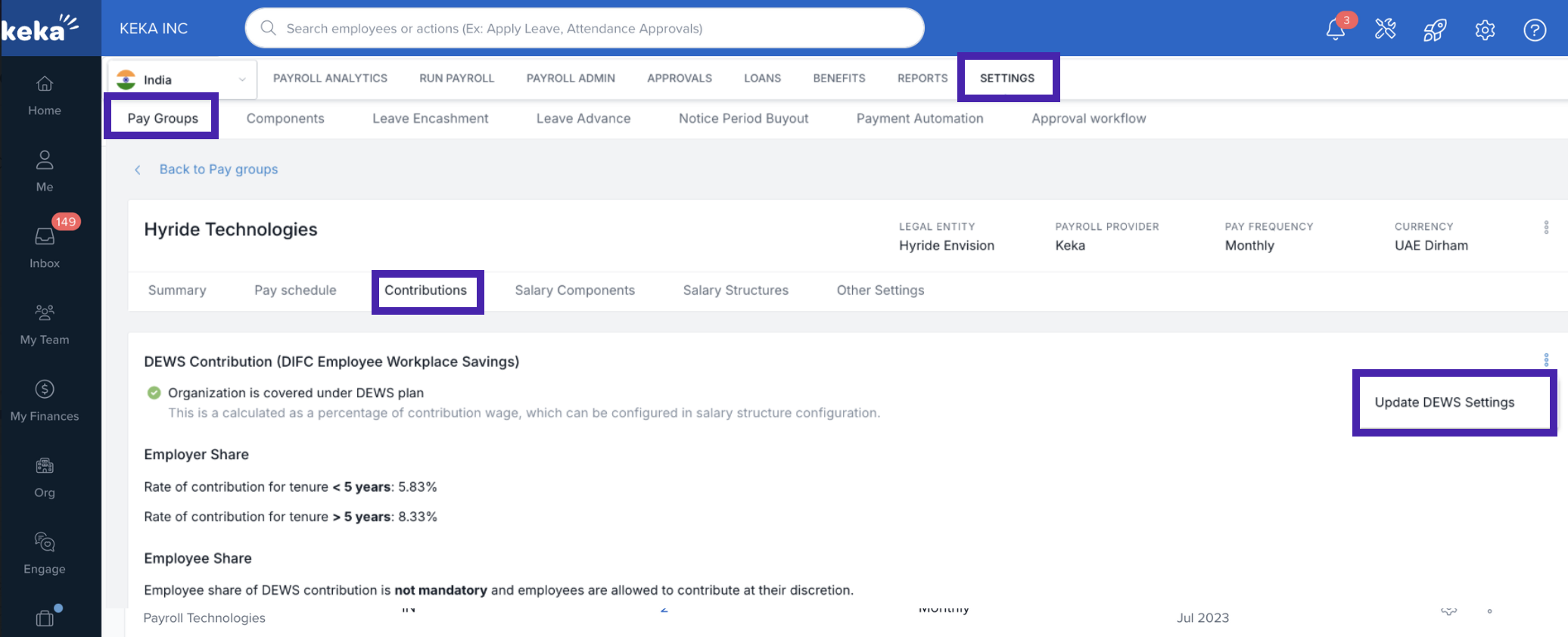

Under Update DEWS Settings, admin will have an option to enable/disable DEWS for the pay group and an option to configure the rate of contribution when the employee's tenure is less than 5 years and greater than 5 years

- Minimum rate of contribution is 5.83%

- Minimum rate of contribution is 8.33%

- Rate of contribution is required

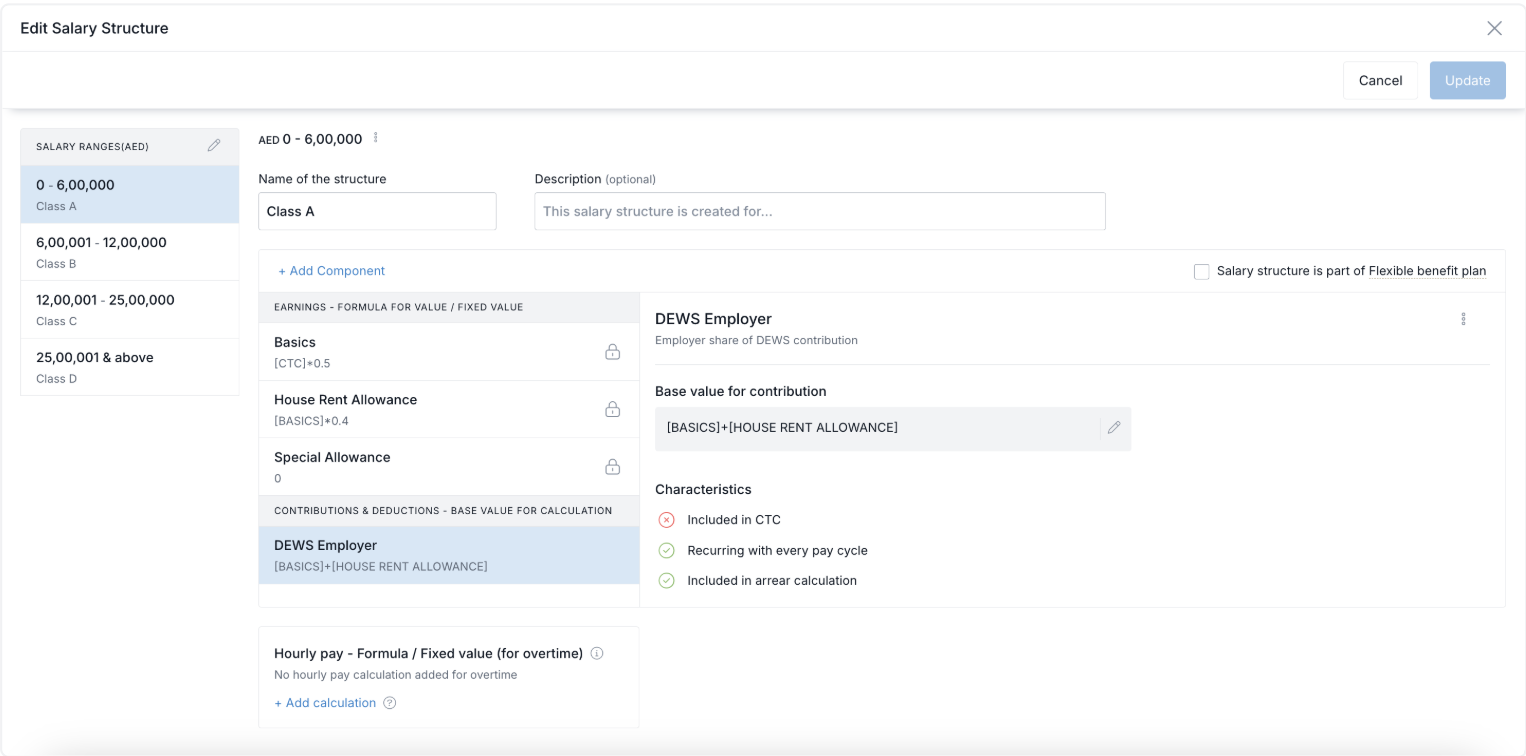

When DEWS is enabled for the pay group, the DEWS Employer Contribution will automatically be added to the salary structure. By default, the base value for DEWS contribution is set to Basic Salary. However, you can adjust this base value as required for your organization.

By following these steps, you can ensure smooth DEWS contribution setup and compliance for employees in the DIFC Free Zone, making payroll management seamless in Keka.

Comments

0 comments

Please sign in to leave a comment.