Introduction

If you’re processing payroll for a U.S.-based S Corporation or an LLC taxed as an S Corporation, and an employee owns 2% or more of the company, special IRS tax rules apply to their benefits. These rules affect how medical, HSA, and other pre-tax benefits are reported.

This guide explains who qualifies as a 2% shareholder, what changes in benefit eligibility, and how to set up and report their benefits correctly in Keka Payroll.

Defining a 2% Shareholder Under IRS Guidelines

Under IRS rules, a 2% shareholder is any employee who owns more than 2% of the company’s stock. This includes:

Direct ownership (shares held by the employee)

-

Indirect ownership (shares held through a spouse, child, or grandchild)

Compliance Implications for 2% Shareholders

Compliance Implications

For IRS purposes, 2% shareholders are not treated as regular employees when it comes to tax-free benefits.

This means that typically pre-tax deductions must be treated as taxable income:

Medical, dental, and vision premiums

FSA (Flexible Spending Account) contributions

HSA (Health Savings Account) contributions

Group Term Life Insurance (pre-tax version)

If not handled correctly, this can cause:

Incorrect W-2 reporting

Errors in Form 941 filings

IRS penalties

Steps to Configure 2% Shareholder Status in the System

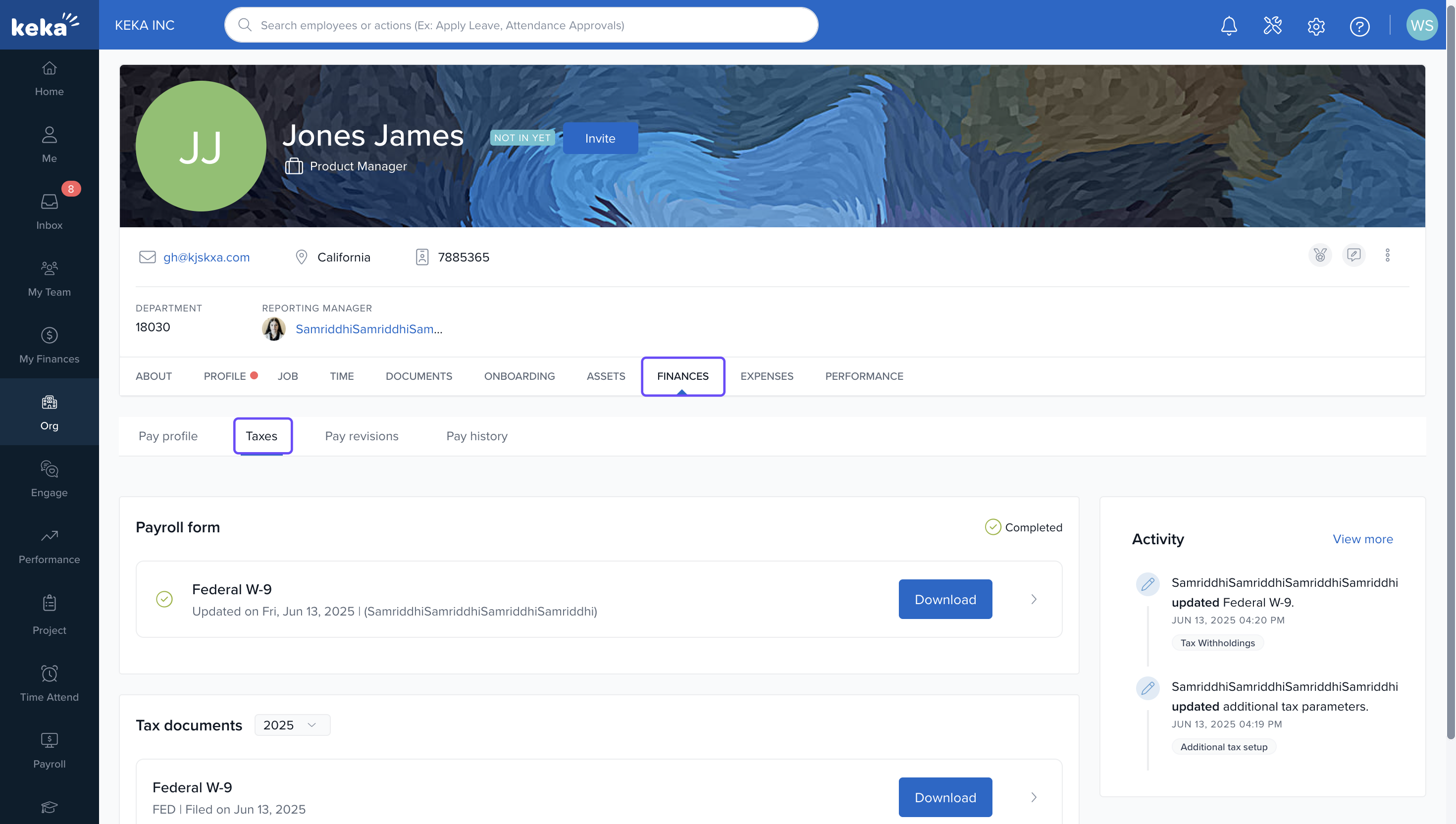

1. Open the employee profile.

2. Go to Finances → Tax.

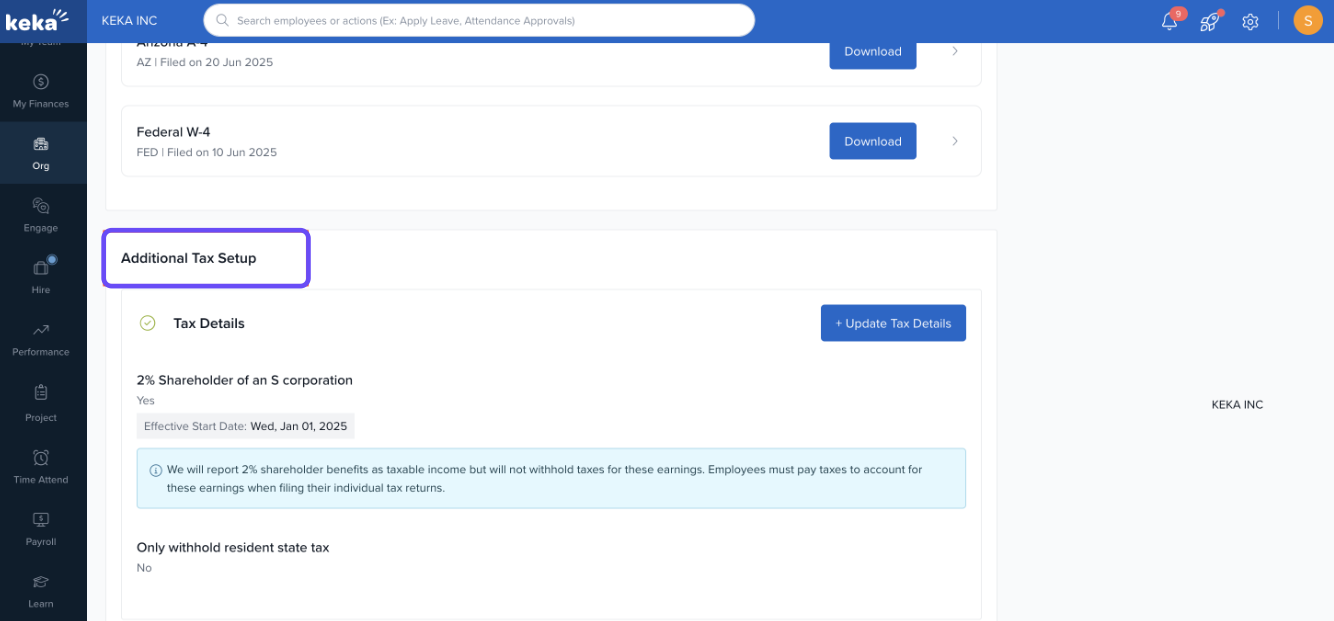

3. Scroll down to Additional Tax Setup

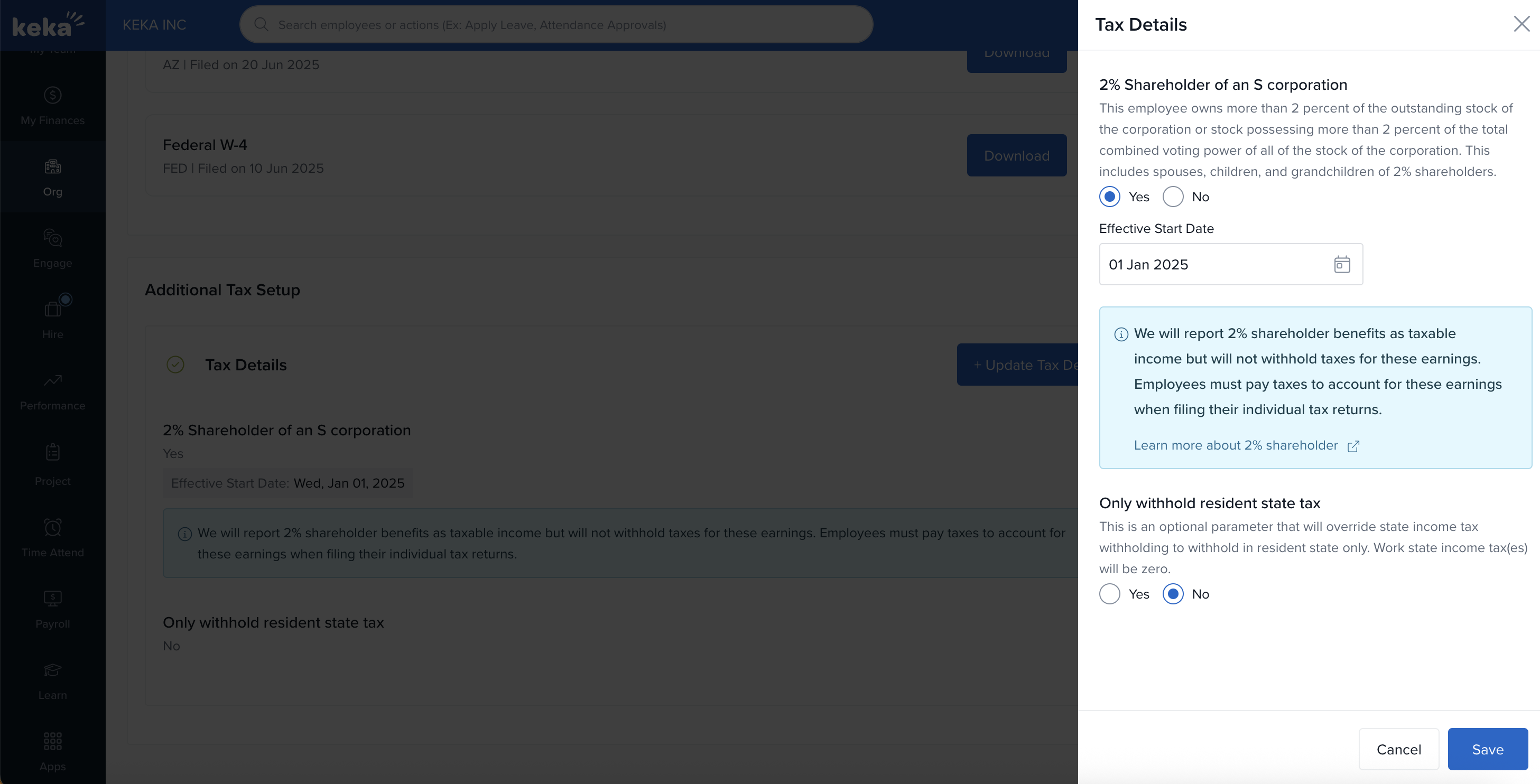

4. Select either:

- 2% Shareholder of an S Corporation

- 2% Shareholder of an LLC (electing S Corp status)

5. Set the option to Yes.

6. Choose an effective start date (must be January 1 of the calendar year).

You must end or remove any pre-tax health benefits before marking an employee as a 2% shareholder. This action can only be performed by privileged users.

Once you're is marked as a 2% shareholder, you become ineligible for any pre-tax health benefits. This includes:

Medical, Vision, and Dental plans

FSA (Flexible Spending Account)

HSA (Health Savings Account)

Group Term Life Insurance (pre-tax version)

Reporting Taxable Benefits for 2% Shareholders

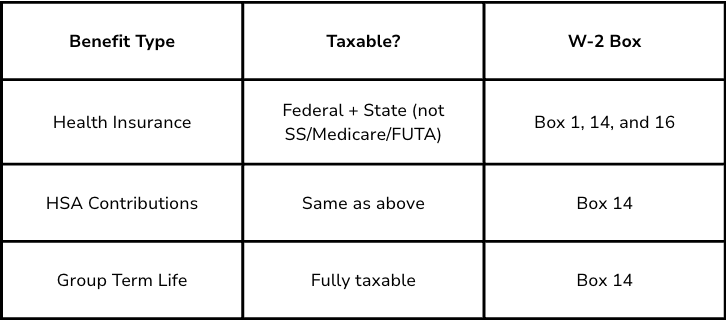

To ensure compliance, taxable benefits for 2% shareholders must be reported as earnings through payroll using dedicated earning components. These components are designed specifically for benefits that are taxable under IRS rules.

Available Earning Components:

2% Shareholder Benefits – For reporting medical and other health-related benefits.

2% Shareholder HSA – For reporting employer HSA contributions.

Group Term Life – For reporting group term life insurance premiums.

These components are only available if the employee has been marked as a 2% shareholder in their tax setup.

While these earnings will be included in the employee’s W-2, no taxes will be withheld by Keka. The employee must handle tax payments when filing their personal returns.

For Group Term Life, the entire premium amount, including the first $50,000, must be reported for 2% shareholders—unlike regular employees, where only the imputed amount over $50,000 is taxable.

W-2 and Tax Reporting Summary

Comments

0 comments

Please sign in to leave a comment.