Introduction

TDS (Tax Deducted at Source) returns are mandatory filings that report the tax deducted from employee payments to the Income Tax Department. In Keka, you can generate Form 24Q, the return form used for salary-related TDS filings.

This guide covers what TDS returns are, types of TDS forms, and how to generate Form 24Q using Keka.

What Are TDS Returns?

When you make payments like salaries, rent, or professional fees, you're required to deduct a specific percentage as tax and deposit it with the government. Once deducted, you must file TDS returns to report the payment and deduction details.

Each TDS return includes:

Deductor (payer) and deductee (payee) details

Amount paid and tax deducted

Type of payment and applicable tax rate

What Is the Process of Filing TDS Returns?

TDS returns are filed online via platforms like the TRACES portal. The frequency and form depend on the type of payment and deductor.

For example:

Form 24Q: Used for salary TDS filings

Form 26Q: For non-salary payments to residents

Form 27Q: For non-salary payments to non-residents

All these forms are typically filed quarterly.

What Are the Different Types of TDS Returns?

Here are the main TDS return types:

| Form | Use Case |

|---|---|

| Form 24Q | Salary TDS returns (used by employers) |

| Form 26Q | TDS for non-salary payments to residents (rent, fees, interest) |

| Form 27Q | TDS for non-salary payments to non-residents (royalty, dividends, etc.) |

How to Generate Form 24Q in Keka

Before you begin, ensure you have the following:

TDS Challans for the quarter

CSI File (Challan Status Inquiry)

Company and Responsible Person details from the e-Filing portal (login with PAN or TAN)

Navigate to Form 24Q

-

Go to Payroll → Payroll Admin → Income Tax & TDS Management (Form 24Q)

Add Challans

Select the Financial Year and Quarter.

-

For each month in the quarter:

Click Manage

Choose to add a single or multiple challans

-

Fill in:

Minor Head Code

TDS Deducted On

Challan Number

Payment Date

BSR Code

Bank Name and Payment Details

Review auto-mapped employees and click Save

Generate Return Files

Click Generate Return Files

Upload the CSI File

-

Choose additional settings:

Include employees with zero TDS

Exclude employees with zero gross earnings

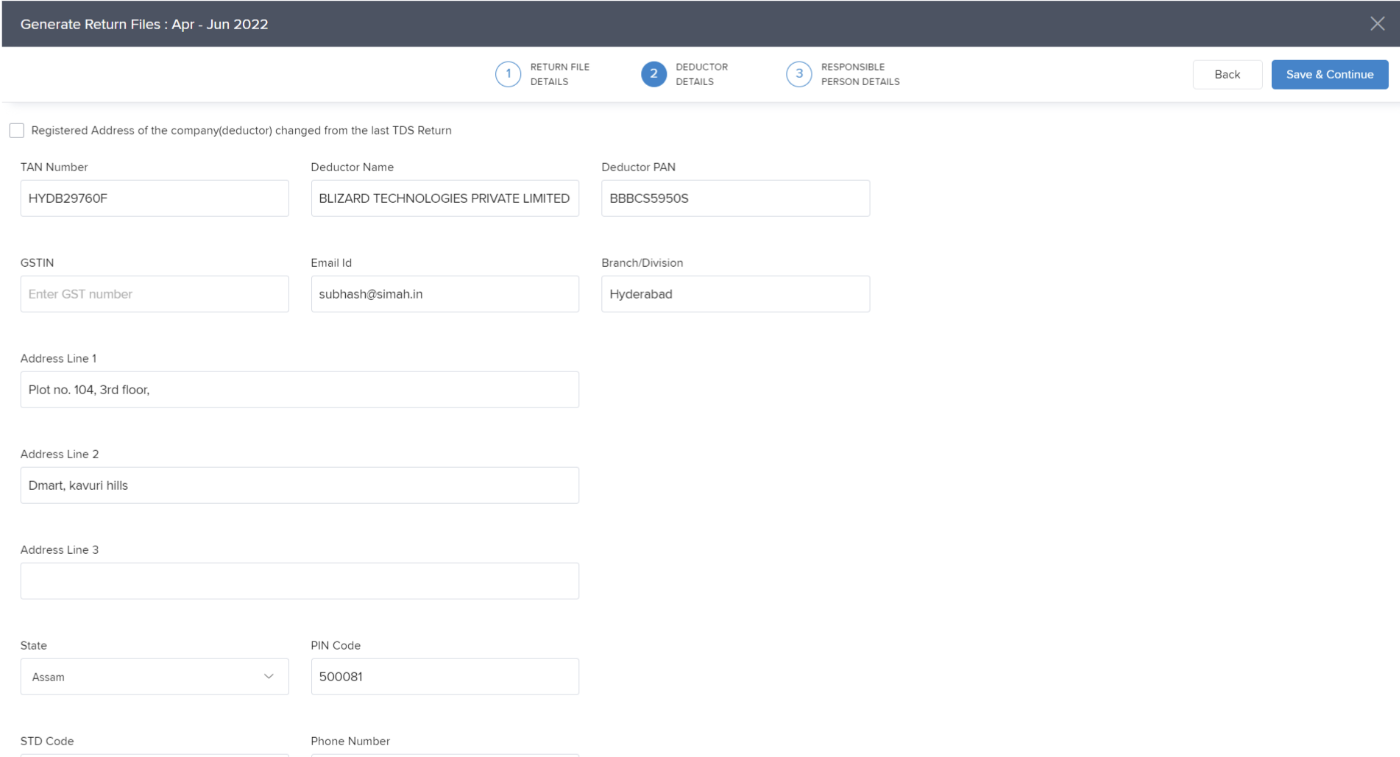

Enter Company Details

Click Save and Continue

-

Add:

TAN Number

Deductor Name

PAN Number

Other required fields

Enter Responsible Person Details

Enter Responsible Person Details

Click Save and Continue

-

Enter:

Name

Designation

PAN Number

Other required fields

Generate Form 24Q

Click Save and Generate FVU

Wait 30–60 seconds for the file generation

If errors appear, click View Errors, resolve them, and regenerate the files

Once successful, download the generated files and upload them to the TRACES portal.

Mark as Filed in Keka

-

After uploading to TRACES and receiving the acknowledgment:

Return to the Form 24Q section in Keka

Click Mark as Filed

Enter the Token Number and Receipt Number

Click Submit

Comments

0 comments

Please sign in to leave a comment.