Introduction

It’s common for monthly income tax deductions to fluctuate, often leaving employees and administrators wondering why. These changes are usually driven by updates to salary, declarations, tax regime, rebates, or other financial details. Without clear visibility, such variations can result in confusion and repeated queries.

Keka makes this process transparent with a feature that highlights and explains changes in Monthly Tax Deductions, helping both employees and admins track what changed and why.

Why Tax Deductions Change

Monthly deductions may vary due to:

Salary revisions

Ad-hoc payments and bonuses

Rejected component claims

Tax regime changes

Rejected employee claims

View Monthly Tax Deduction Details

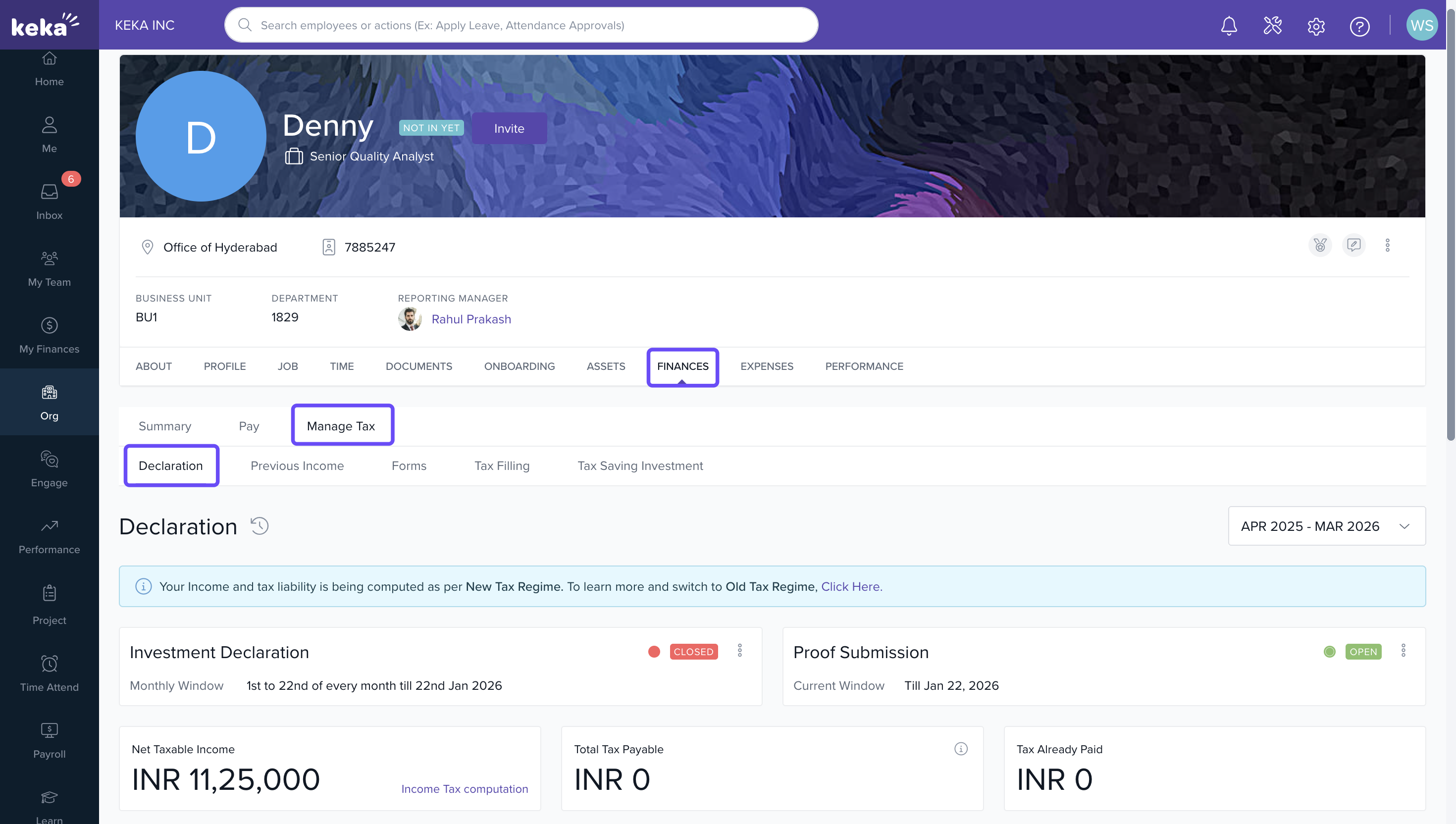

For Admins

1. Search for the employee using the global search bar.

2. In their profile, click Finances.

3. Select Manage Tax.

4. Go to the Declarations section.

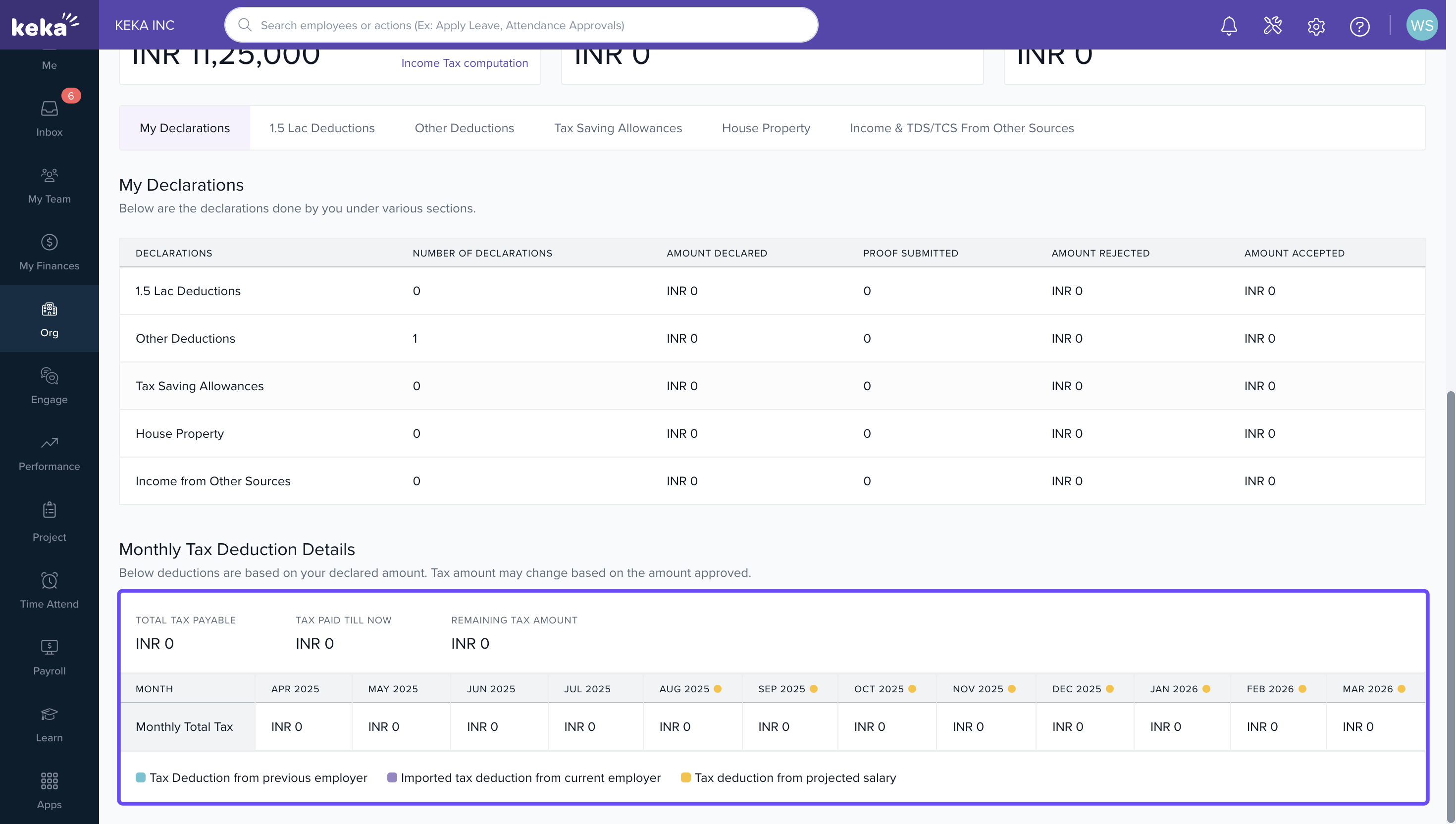

5. Scroll down to Monthly Tax Deduction Details.

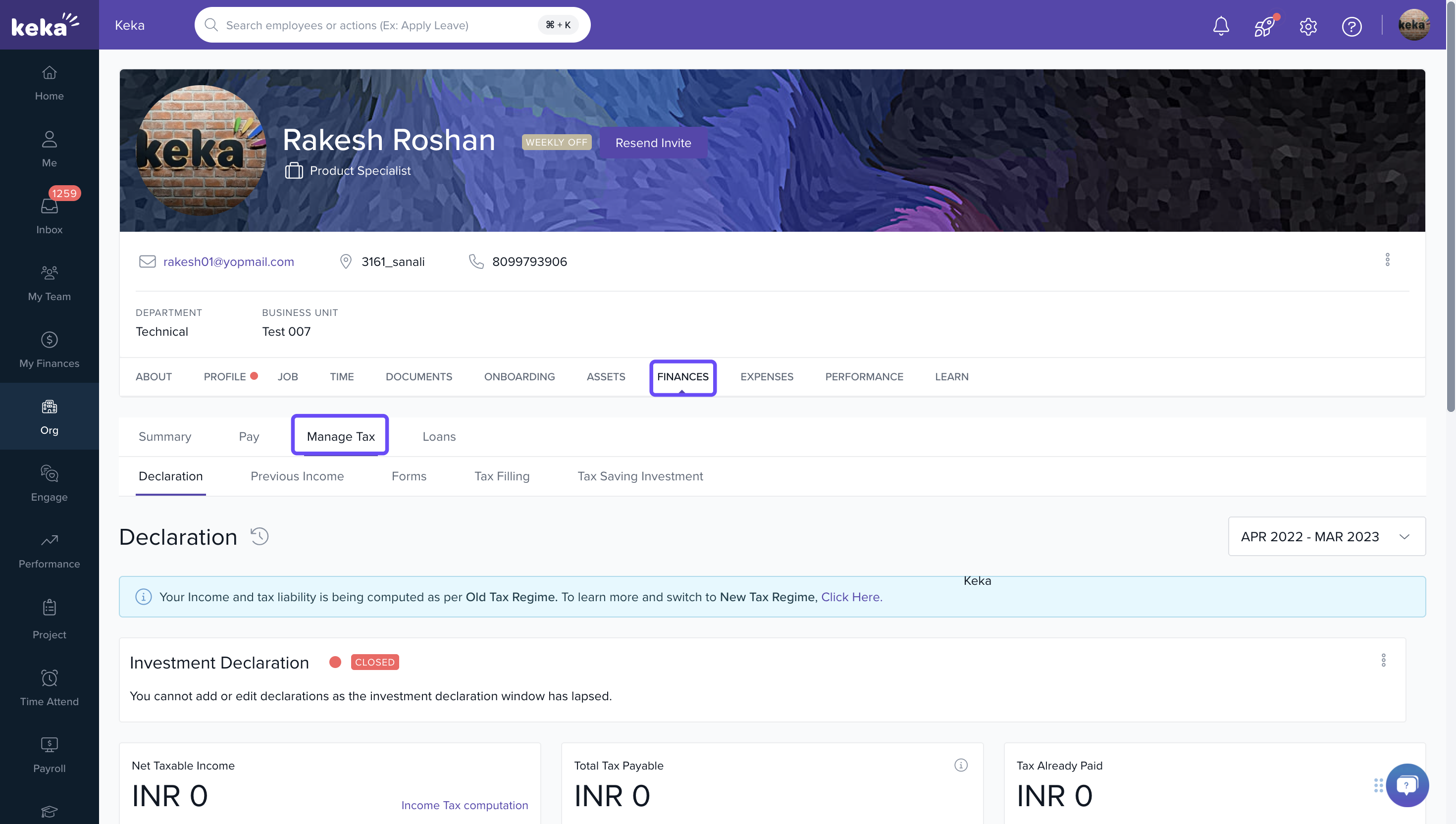

For Employees

Employees can view the same details by going to their own profile and following the same steps.

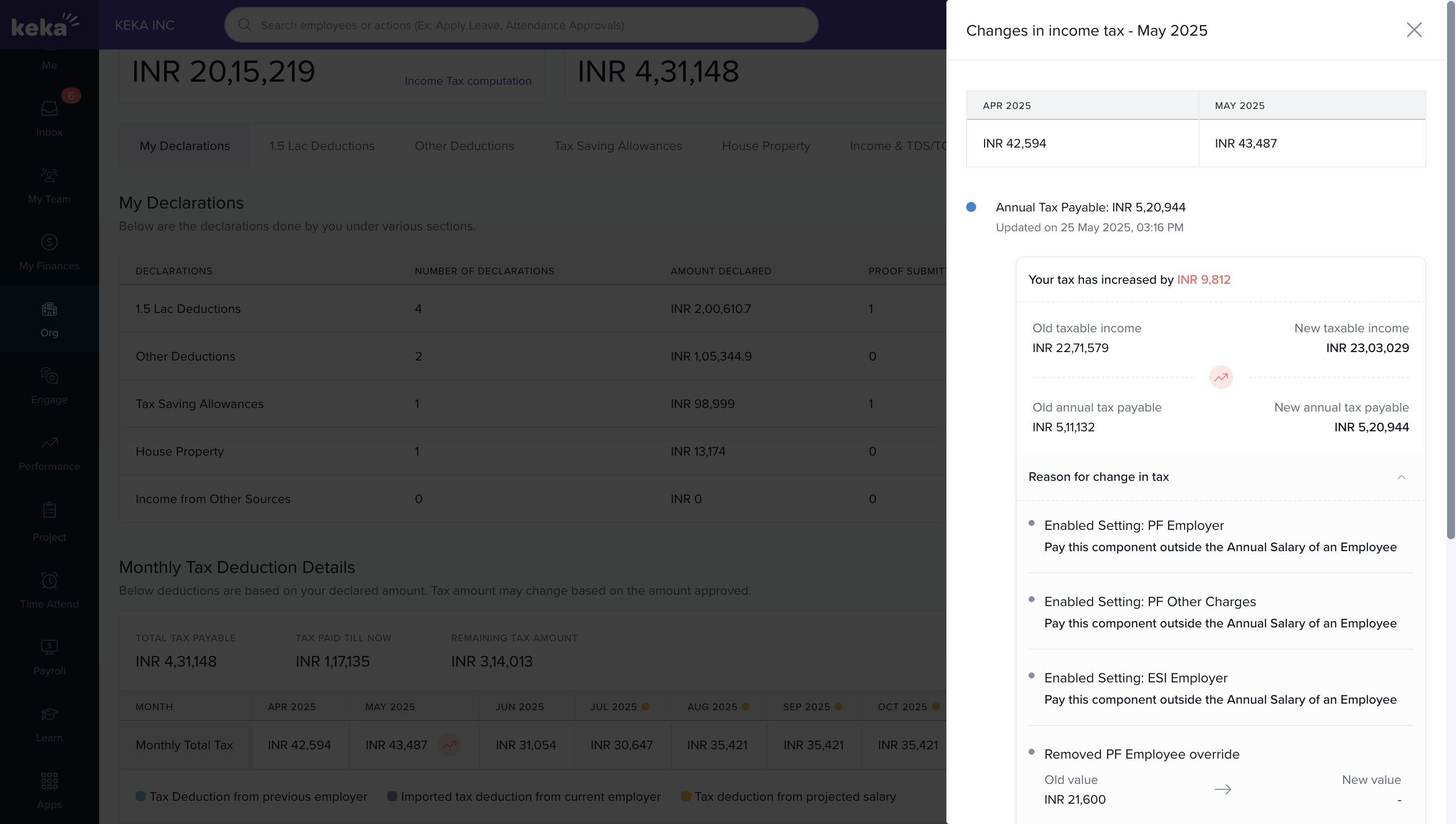

Indicators of Change

Red arrow → Tax amount has increased.

Green arrow → Tax amount has decreased.

Click the arrow next to a tax amount to open a pop-up explaining the exact reasons for the change.

Payroll finalization: Changes and reasons are only captured after payroll is finalized for the month and the tax differs from the previous finalized month.

Component-level changes: Only visible to privileged users. Employees will need to contact admins for details.

Rollback & re-finalization: If payroll is rolled back and re-finalized, changes are captured each time, and differences will be shown.

April exception: No change logs are shown for April, as it is the base month for the financial year’s tax projections.

Cross-check: You can verify your tax calculation against the government’s Income Tax e-Filing portal.

In summary, understanding the reasons behind changes in tax projections is key to managing your finances. The feature we have introduced simplifies this process, reducing the need for questions by providing clarity to your income tax. Embrace this change, and take control of your financial future.

Comments

0 comments

Please sign in to leave a comment.