- Admin Help Center

- Payroll

- Payroll FAQs

-

Getting Started with Keka

-

Core HR

-

Payroll

-

Leave & Attendance

-

Performance

-

Keka Hire

-

Professional Services Automation

-

Expenses & Travel

-

HelpDesk

-

Billing Portal

-

Pricing Plans & Subscriptions

-

Videos

-

Manager Actions

-

Employee's User Guide

-

Keka Learn

-

IT Admin Articles

-

Troubleshooting Guides

-

Employee Engagement

-

API

-

Employee Experience

Importing investment declarations in bulk

Investment declarations are vital in calculating the total income tax that any employee has to pay. Since it is mandatory for organisations to deduct tax every month in the form of TDS, having the investment declarations updated on the Keka HR Portal is important to ensure that the correct tax amount gets deducted every month.

Importing investment declaration will be an important action if you are starting to use Keka in the middle of the financial year or if the employees have already made investment declarations offline but it needs to be uploaded onto Keka.

Here's how you do it.

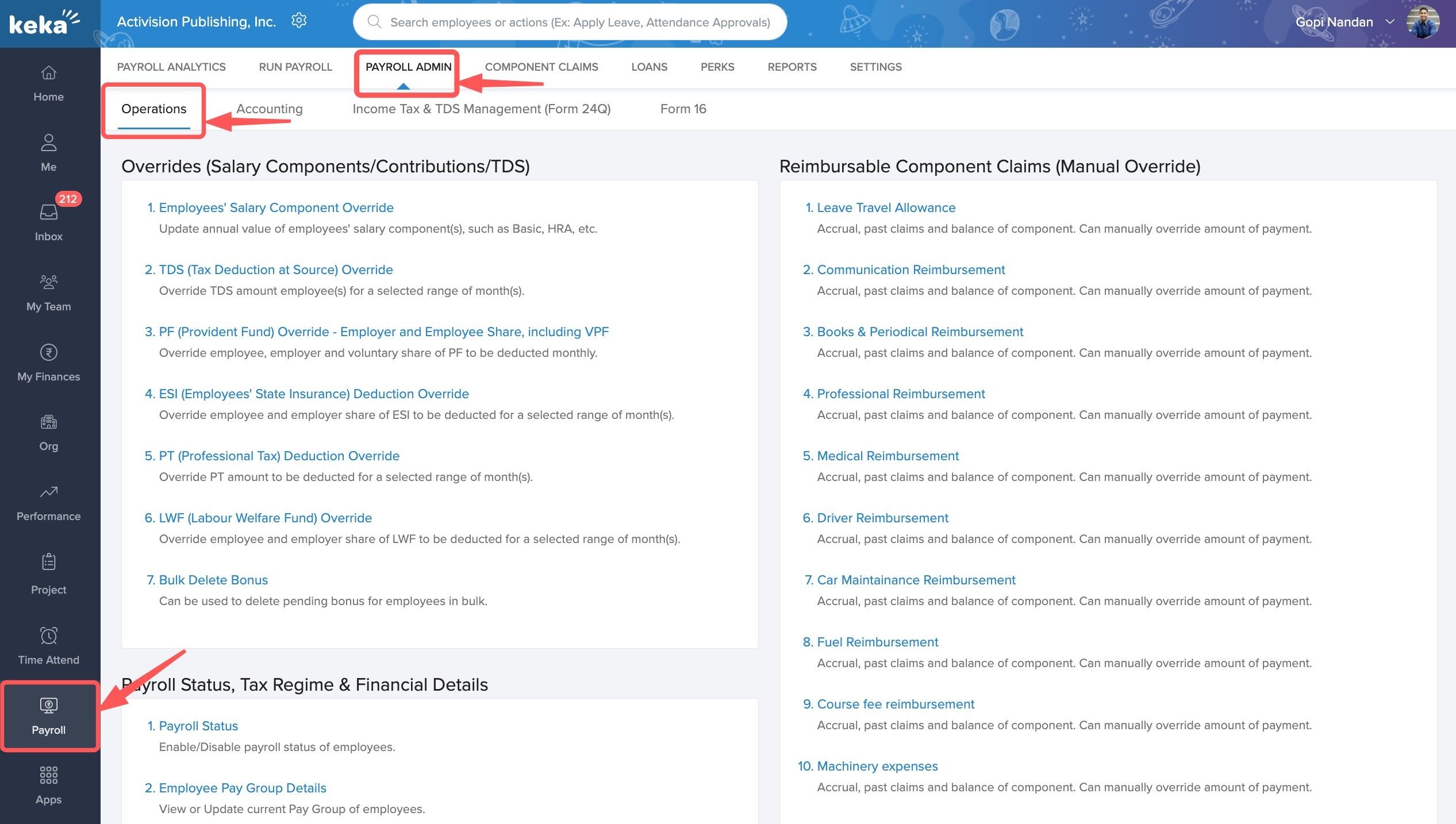

Navigate to Payroll from the left navigation pane. Select the Payroll Admin and then select the Operations tab.

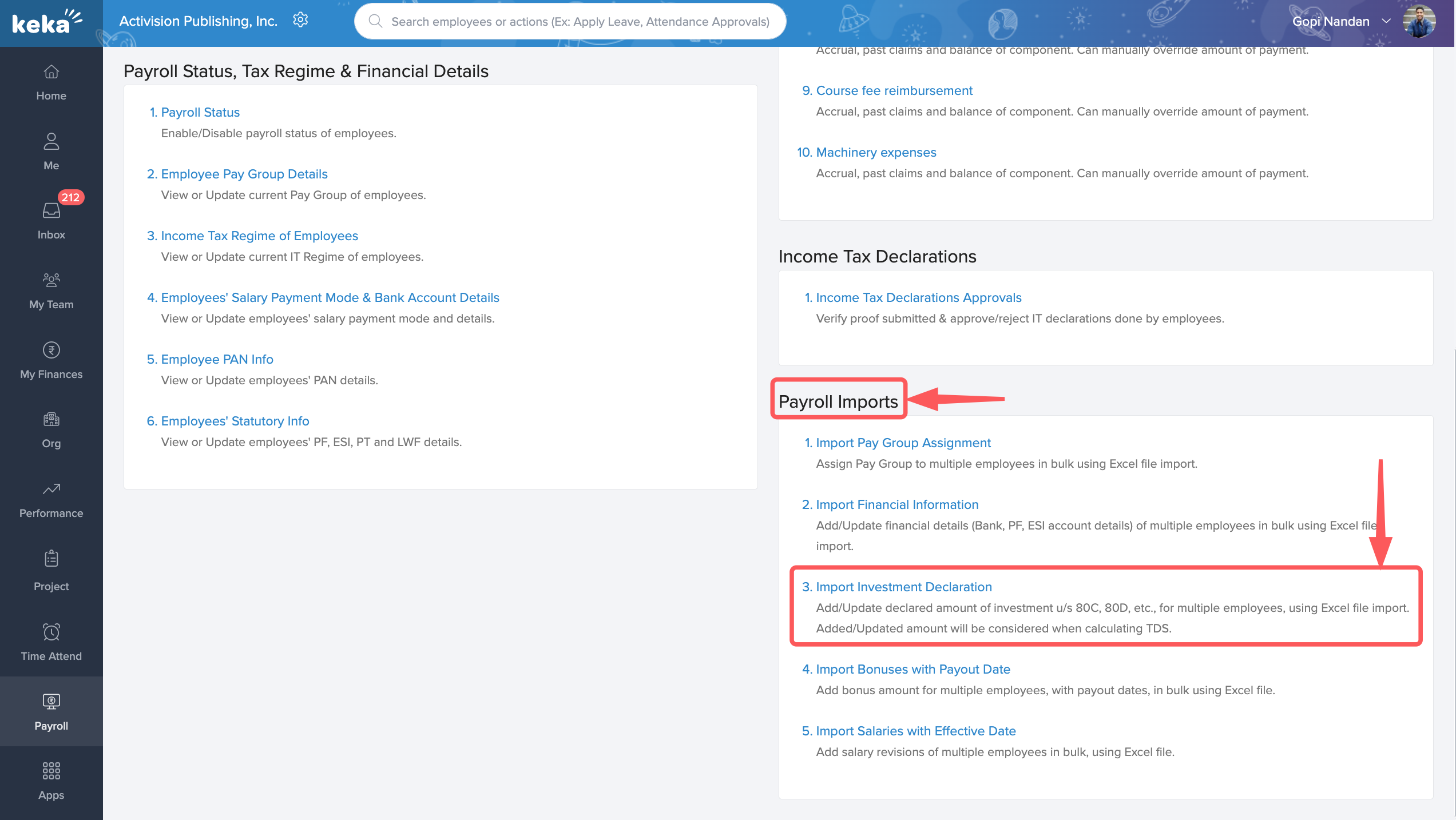

Find the Payroll Imports section on this page and click on Import Investment Declaration.

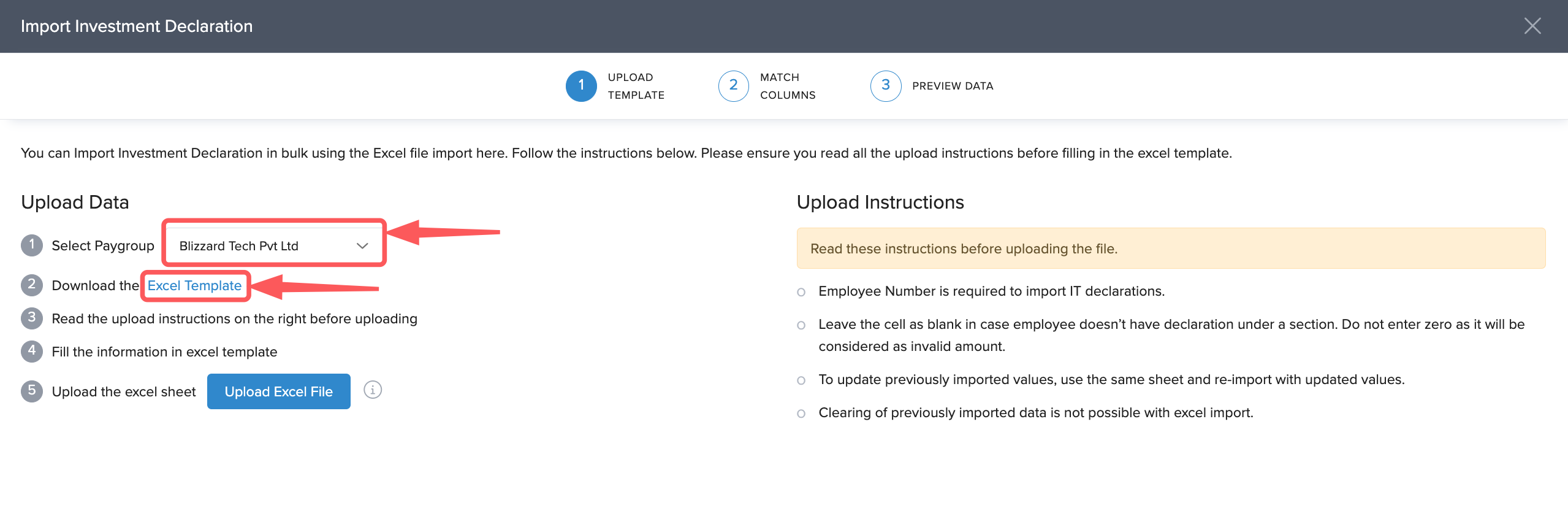

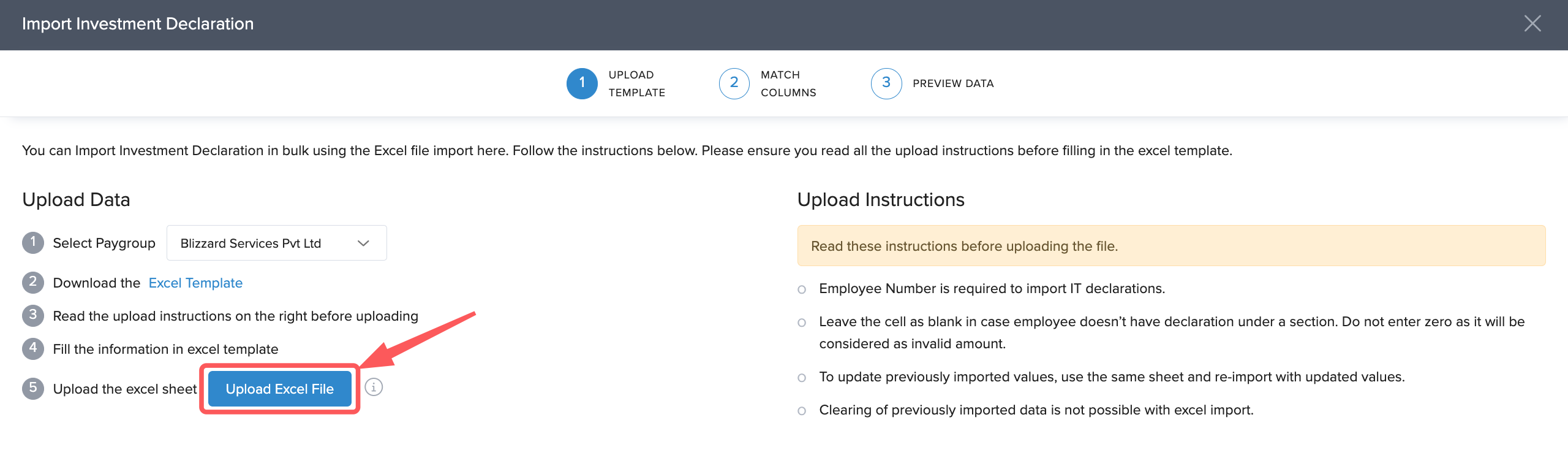

In the Import Investment Declaration window, select the Pay Group for which you want the declarations to be imported if you have more than one pay group configured. Click on Download the Excel Template to download the template with all the employees from that pay group.

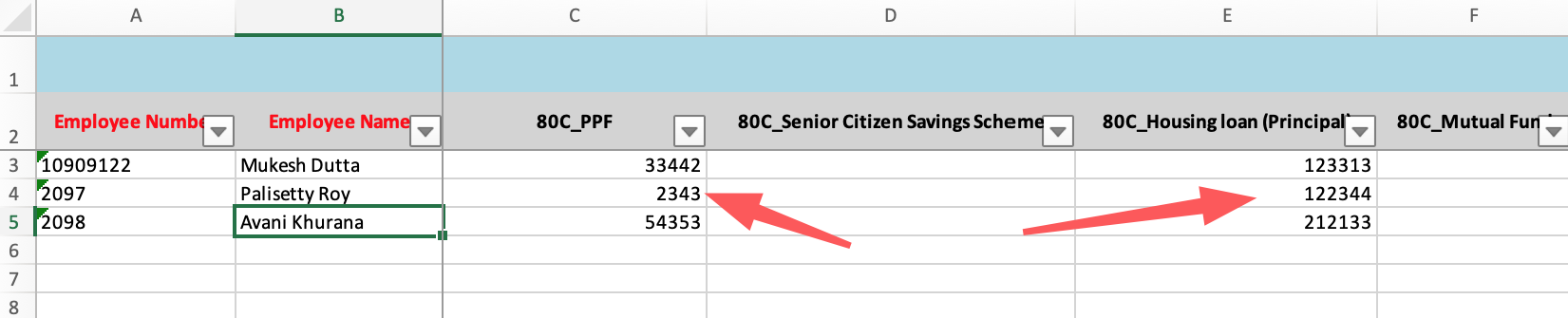

In the downloaded excel file, keep the rows corresponding to the employees you want to edit the investment declaration details for and delete the rest of the rows.

Enter the various investment details under the various deductions. Save the file when you are done making the changes.

Switch back to the Import Investment Declaration window and click Upload Excel File. Select the file you have saved and upload it on the system.

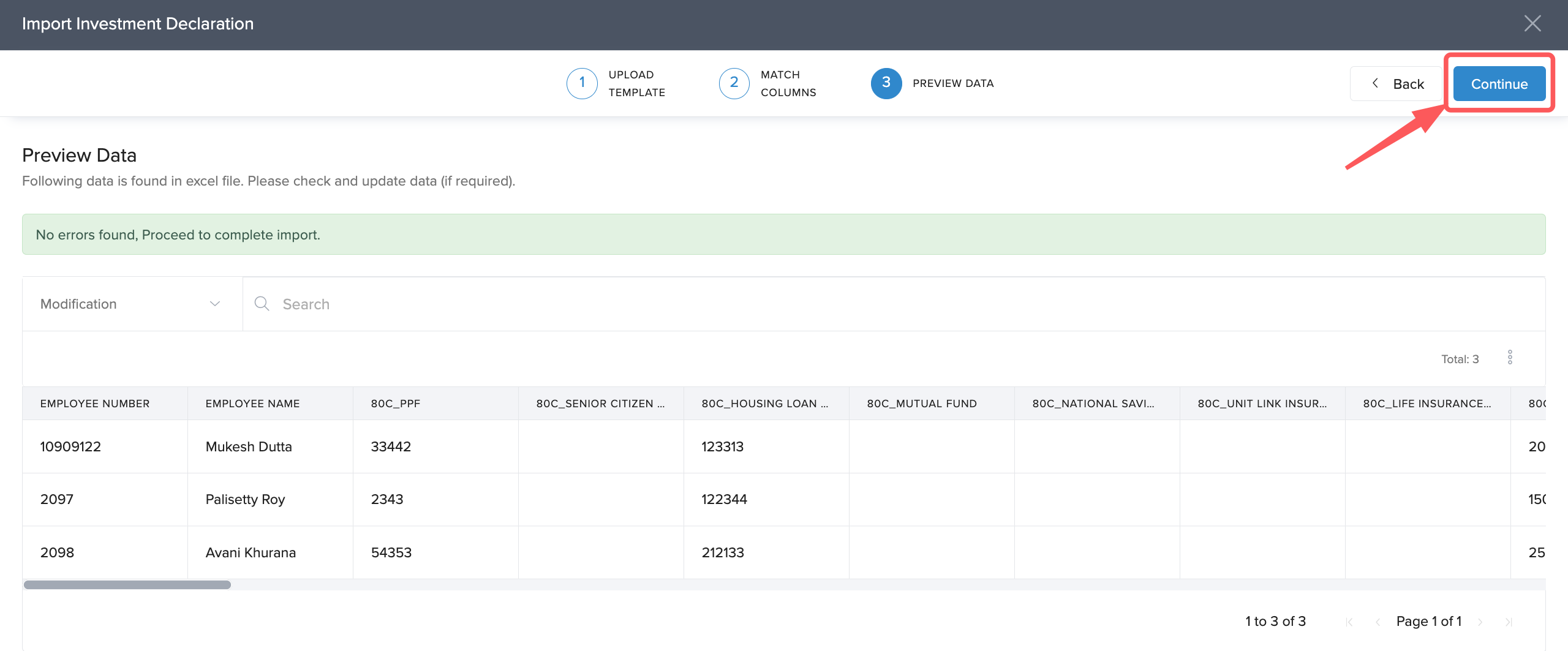

In the Match Columns section, ensure that the columns on Excel are correctly mapped to the fields on Keka. Click Continue to move to the Preview Data section. Here, correct any errors if you have in the excel file and then click Continue.

Click Confirm on the confirmation window to complete the upload of the data.

This will complete the update of investment declaration for your employees on Keka. The TDS values will now be calculated based on the updated declaration.

Hope this helps you understand how investment declaration can be imported in bulk on Keka. More questions? Talk to our product experts today!