- Admin Help Center

- Payroll

- Payroll FAQs

-

Getting Started with Keka

-

Core HR

-

Payroll

-

Leave & Attendance

-

Performance

-

Keka Hire

-

Professional Services Automation

-

Expenses & Travel

-

HelpDesk

-

Billing Portal

-

Pricing Plans & Subscriptions

-

Videos

-

Manager Actions

-

Employee's User Guide

-

Keka Learn

-

IT Admin Articles

-

Troubleshooting Guides

-

Employee Engagement

-

API

-

Employee Experience

How to set the default HRA to Rs.1 lakh

HRA, which stands for House Rent Allowance, is the compensation paid by an employer to an employee for the rent paid to live in the place of employment. While the deduction for HRA under Section 10(13A) of the Income Tax Act is allowed, the taxability of HRA depends on various factors, including the employee's salary, the amount of HRA received from the employer, the actual rent paid by the employee, and the location of employment and residence.

In order to claim the deduction for HRA from their net taxable income, employees need to provide details such as the rent amount paid, the landlord's PAN and address, city of residence, and more.

Setting the default HR Allowance to Rs. 1 lakh can be done in 4 steps.

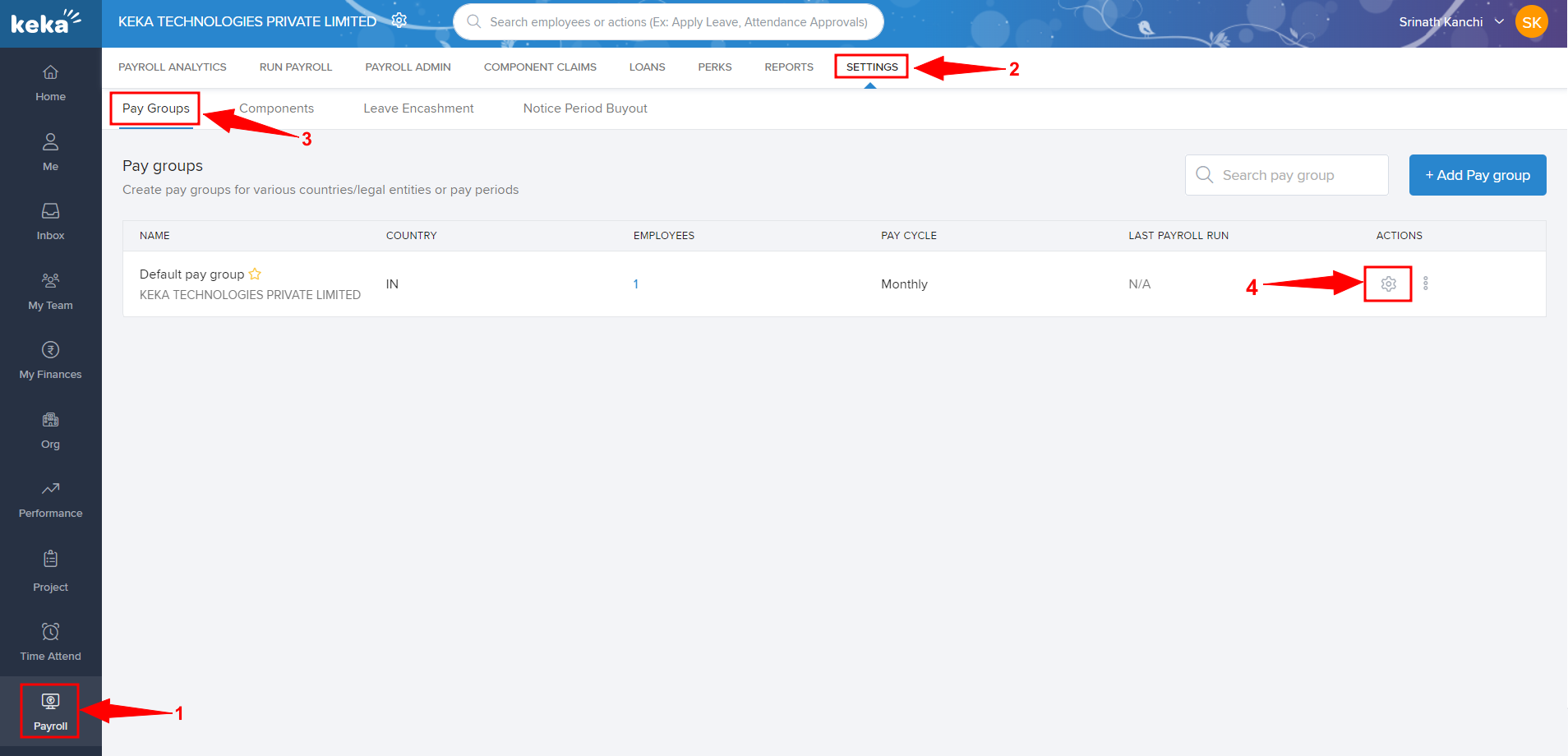

Step 1

Click on the Payroll (1) tab. Go to Settings (2) and then, click on Pay Groups (3). Choose your pay group (if you have many) and click on the configure icon (4) under Actions.

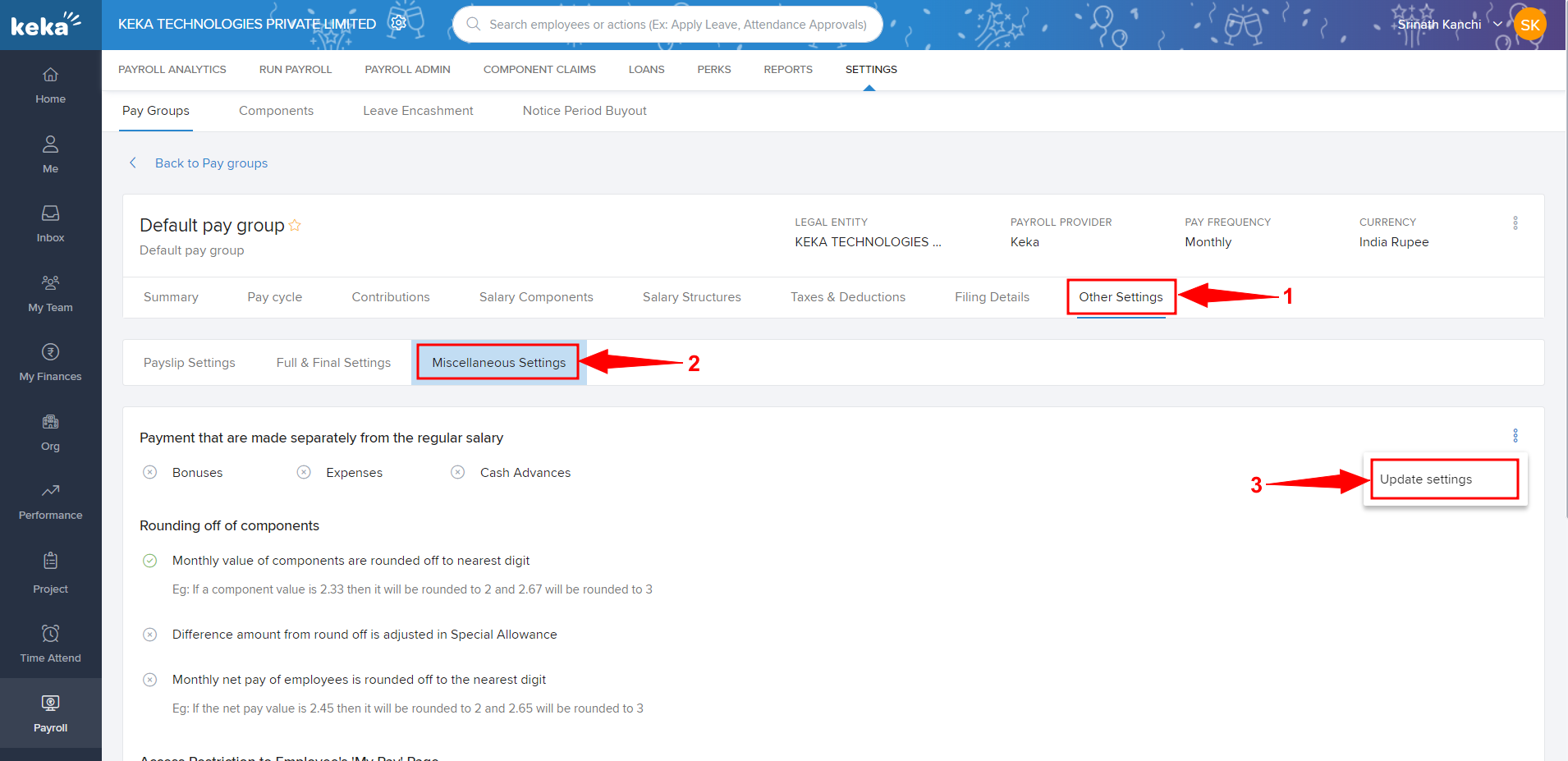

Step 2

On the new page that pops up after clicking the configure icon, click on Other Settings (1) and then on Miscellaneous Settings (2). Now, click on the 3 dots, and select Update settings (3).

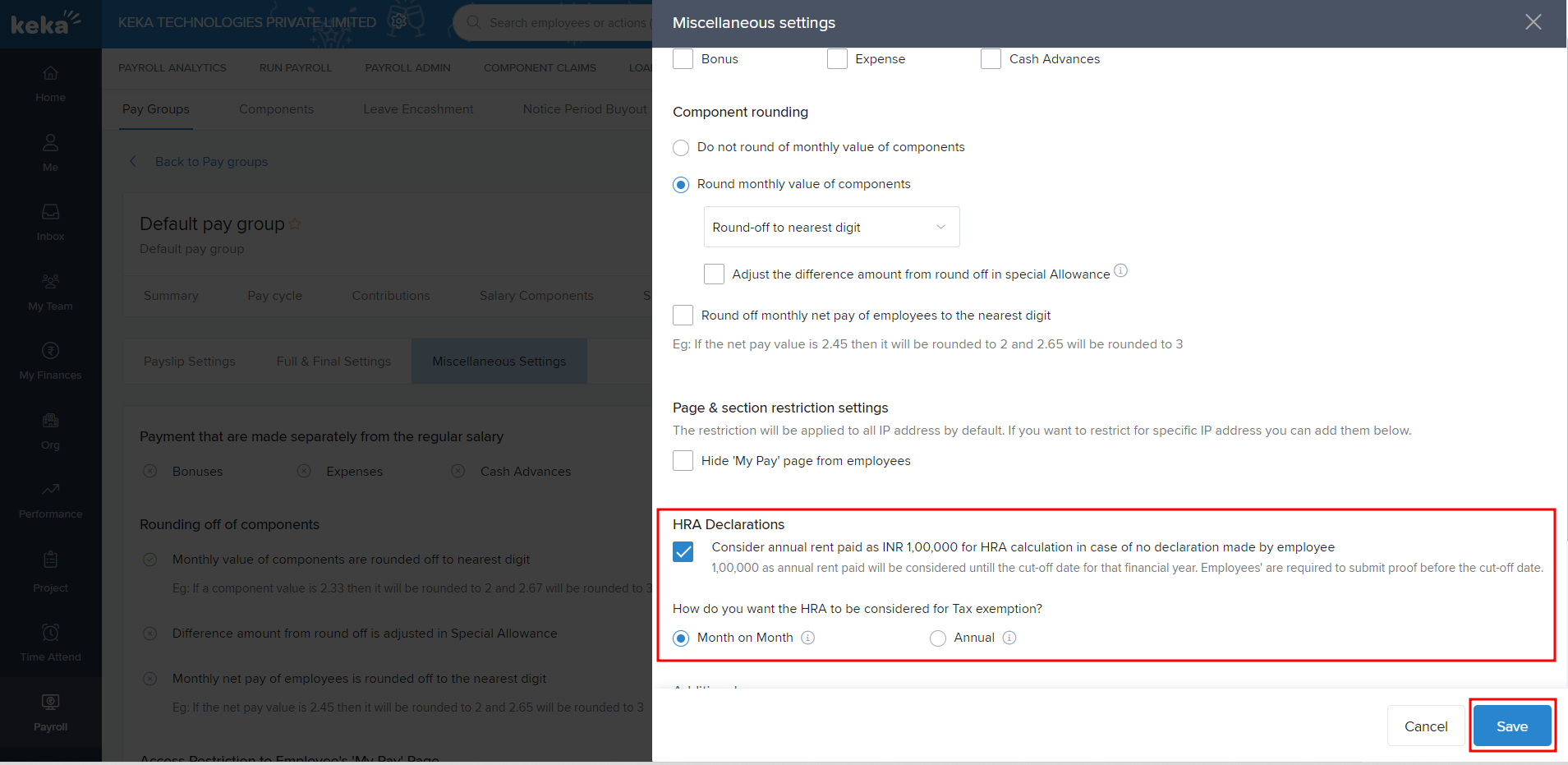

Step 3

On the window that opens, scroll down to find HRA Declarations. Under it, check the box (1) against the dialogue that says: 'Consider annual rent paid as INR 1,00,000 for HRA calculation...'. Then, select how the HRA is to be considered for tax exemption.

Once done, click Save.

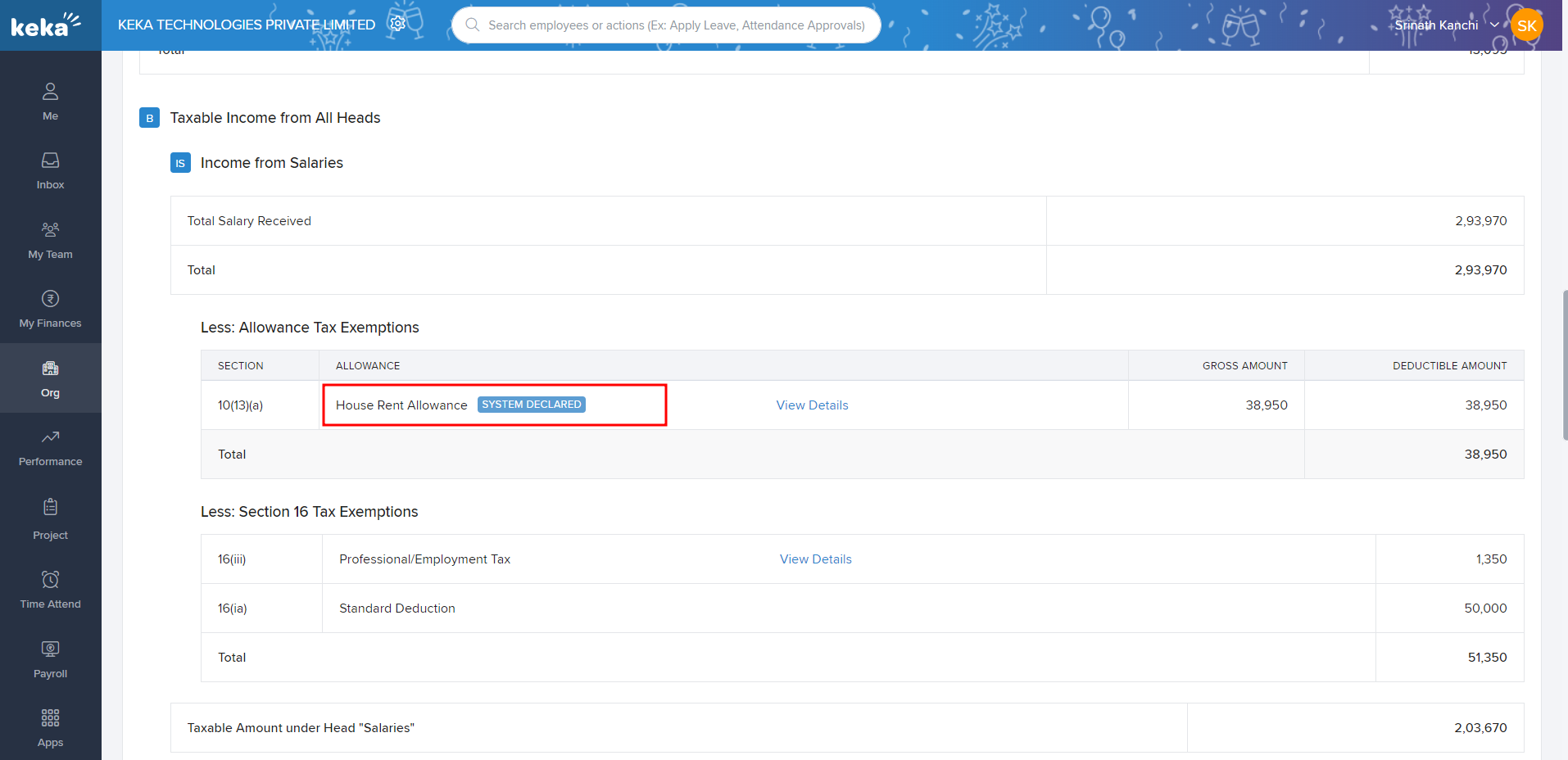

Now for the employee of the pay group, the HRA will be marked 'System Calculated' in their tax computations.

And you are done! If you have any more questions, please go through the other articles or talk to our product experts.