- Admin Help Center

- Payroll

- Payroll FAQs

-

Getting Started with Keka

-

Core HR

-

Payroll

-

Leave & Attendance

-

Performance

-

Keka Hire

-

Professional Services Automation

-

Expenses & Travel

-

HelpDesk

-

Billing Portal

-

Pricing Plans & Subscriptions

-

Videos

-

Manager Actions

-

Employee's User Guide

-

Keka Learn

-

IT Admin Articles

-

Troubleshooting Guides

-

Employee Engagement

-

API

-

Employee Experience

How to generate quarterly returns (Form 24Q)

Form 24Q is a comprehensive document for taxpayers to declare their TDS returns in detail. It comprises of two Annextures - Annexure 1 and Annexure 2. While Annexure 1 contains details of the deductor, challans, and deductee, it does not include salary details. This annexure needs to be submitted for all four quarters of the financial year. On the other hand, Annexure 2 must be submitted during the first three quarters of the financial year and includes detailed information about the salary, along with all deductions that the employee needs to claim.

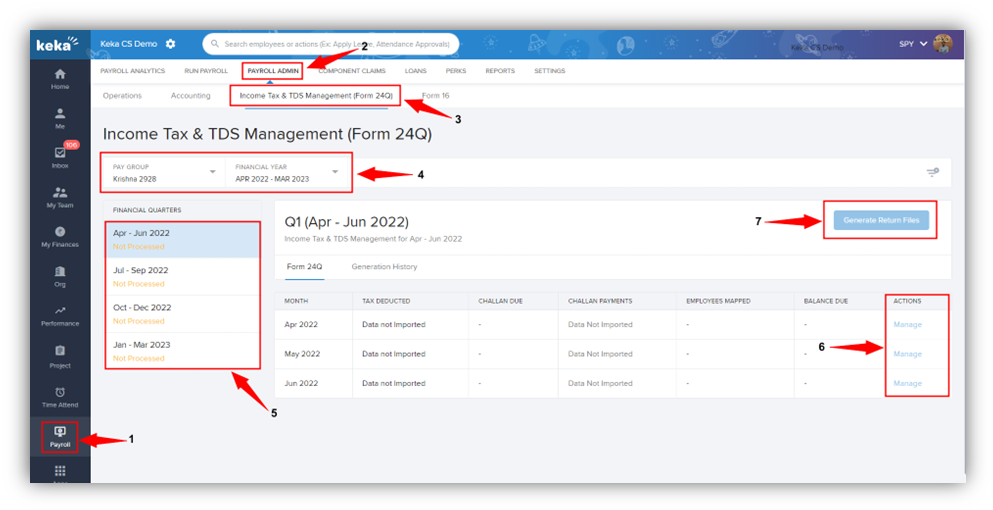

In order to generate quarterly returns (Form 24Q), log in to the Keka portal and click on Payroll (1). Go to PAYROLL ADMIN (2) and choose Income Tax & TDS Management (Form 24Q) (3). Choose the PAY GROUP (4) (if you have multiple pay groups) and the FINANCIAL YEAR (4). Select the FINANCIAL QUARTER (5) in which you can add the challans. Now, click on Manage (6).

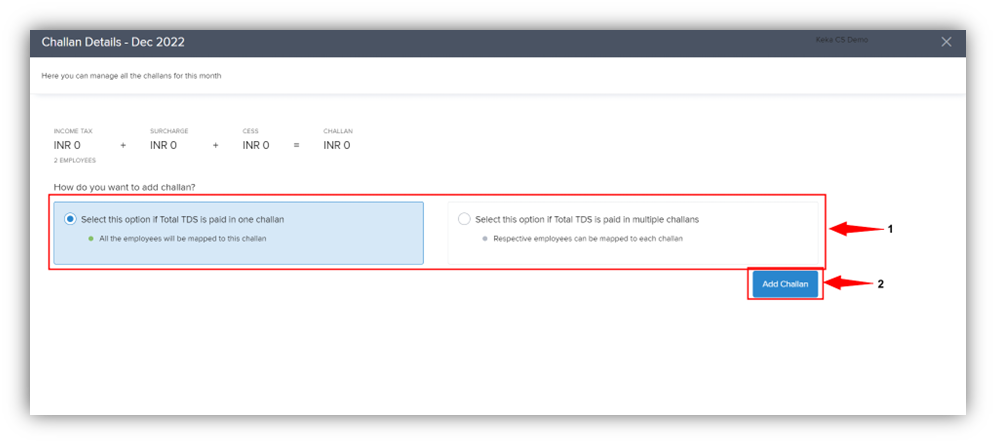

On the window that pops up next, choose your answer to: 'How do you want to add the challan?' Now, click on 'Add Challan'. Here, you can add the challan paid to the Income Tax department.