- Admin Help Center

- Payroll

- Payroll FAQs

-

Getting Started with Keka

-

Core HR

-

Payroll

-

Leave & Attendance

-

Performance

-

Keka Hire

-

Professional Services Automation

-

Expenses & Travel

-

HelpDesk

-

Billing Portal

-

Pricing Plans & Subscriptions

-

Videos

-

Manager Actions

-

Employee's User Guide

-

Keka Learn

-

Mobile App

-

IT Admin Articles

-

Troubleshooting Guides

-

Employee Engagement

-

API

How to download the annual income tax detailed report?

An income Tax Return (ITR) is an annual process in which you submit the details of your income and expenditures to calculate the income tax that you are supposed to pay. In Keka, the Annual Income Tax Detailed Report gives you the details pertaining to income tax paid by each employee in that year and the details of the income and tax savings that has been submitted.

Below is the path from where you can check and download the income tax detailed report.

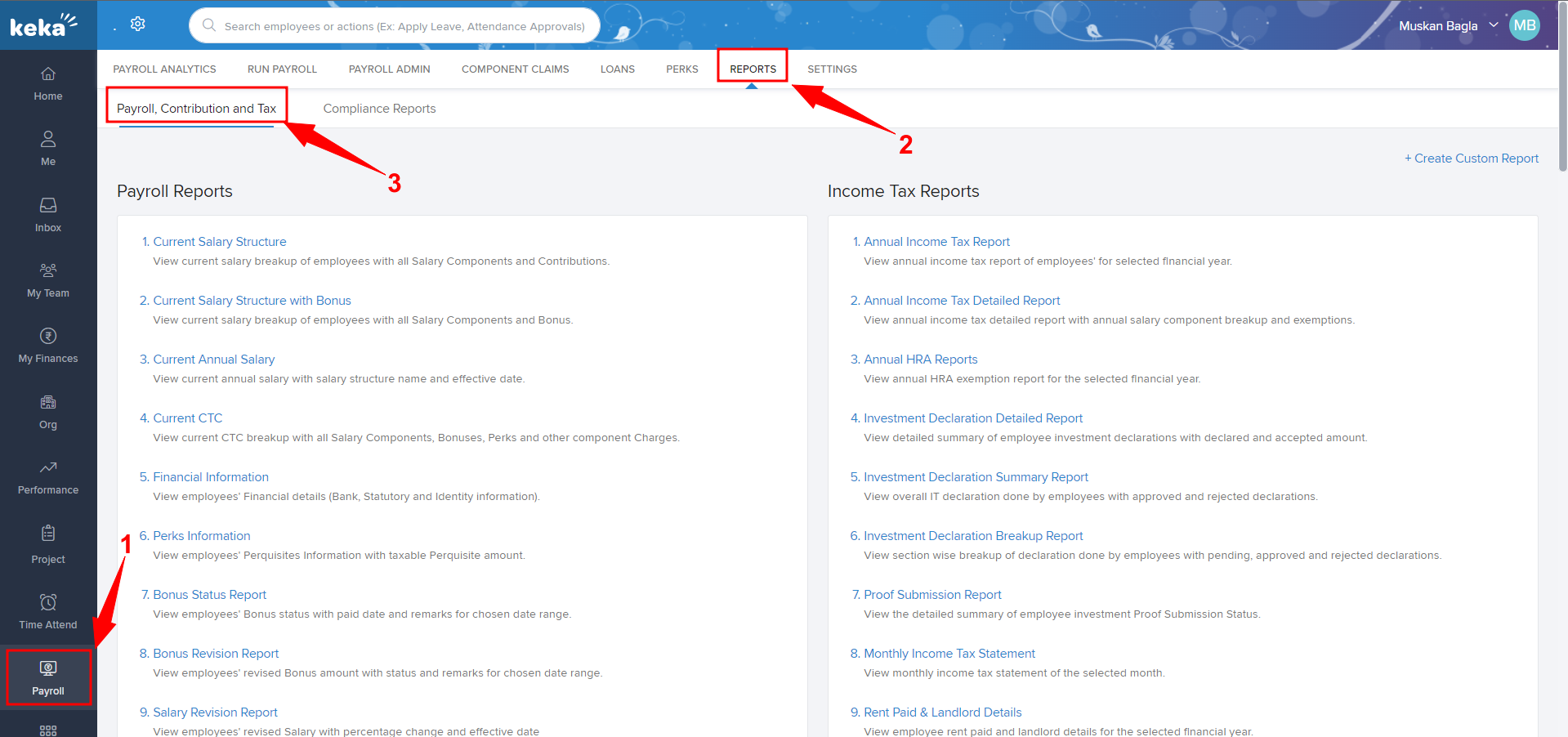

Go to the Payroll (1) section of the Keka Portal and click on Reports (2). Then go to the Payroll, Contribution, and Tax (3) tab.

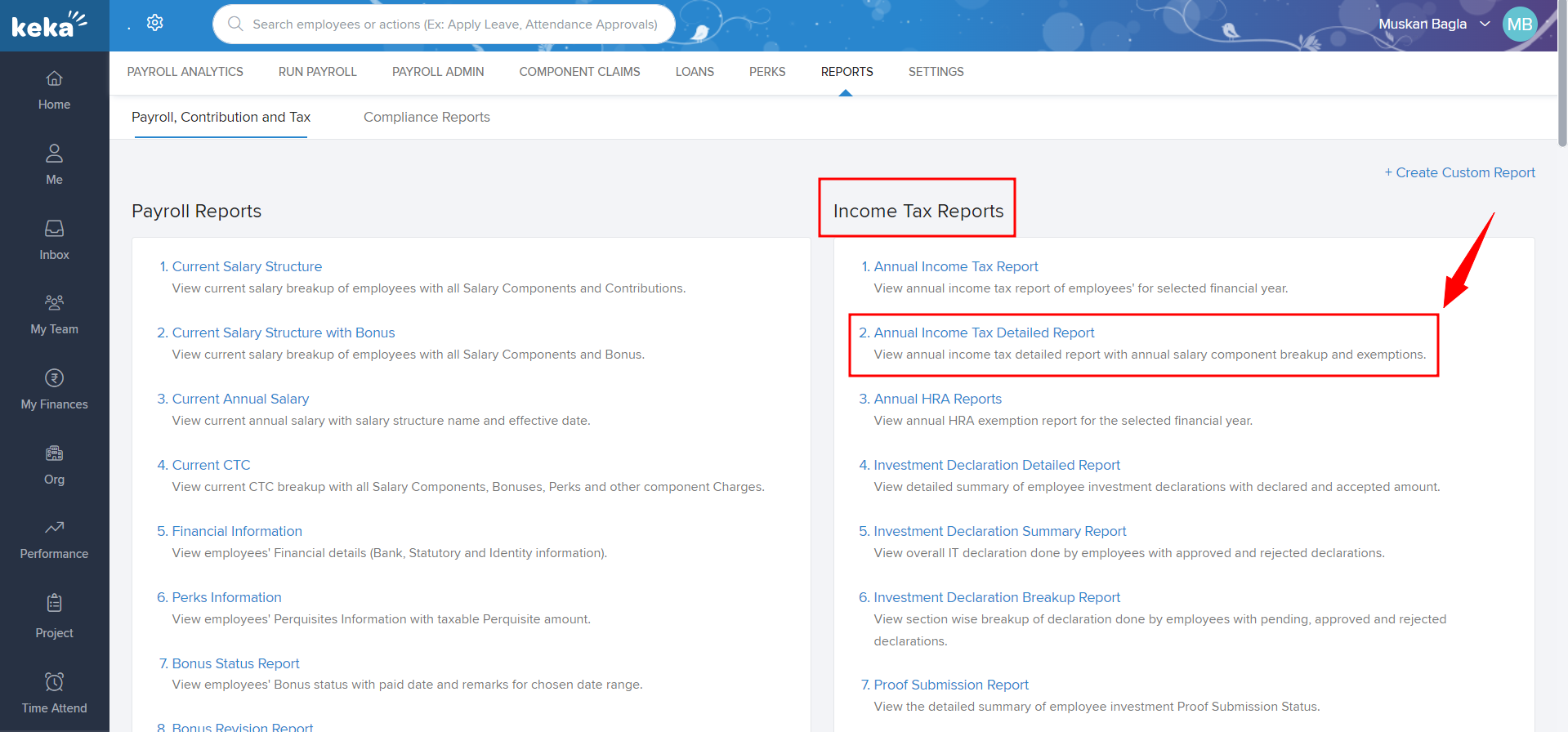

Once you click on the Payroll, Contribution, and Tax tab, go to the Income Tax Report section and click on Annual Income Tax Detailed Report (as highlighted with an arrow mark in the below picture)-

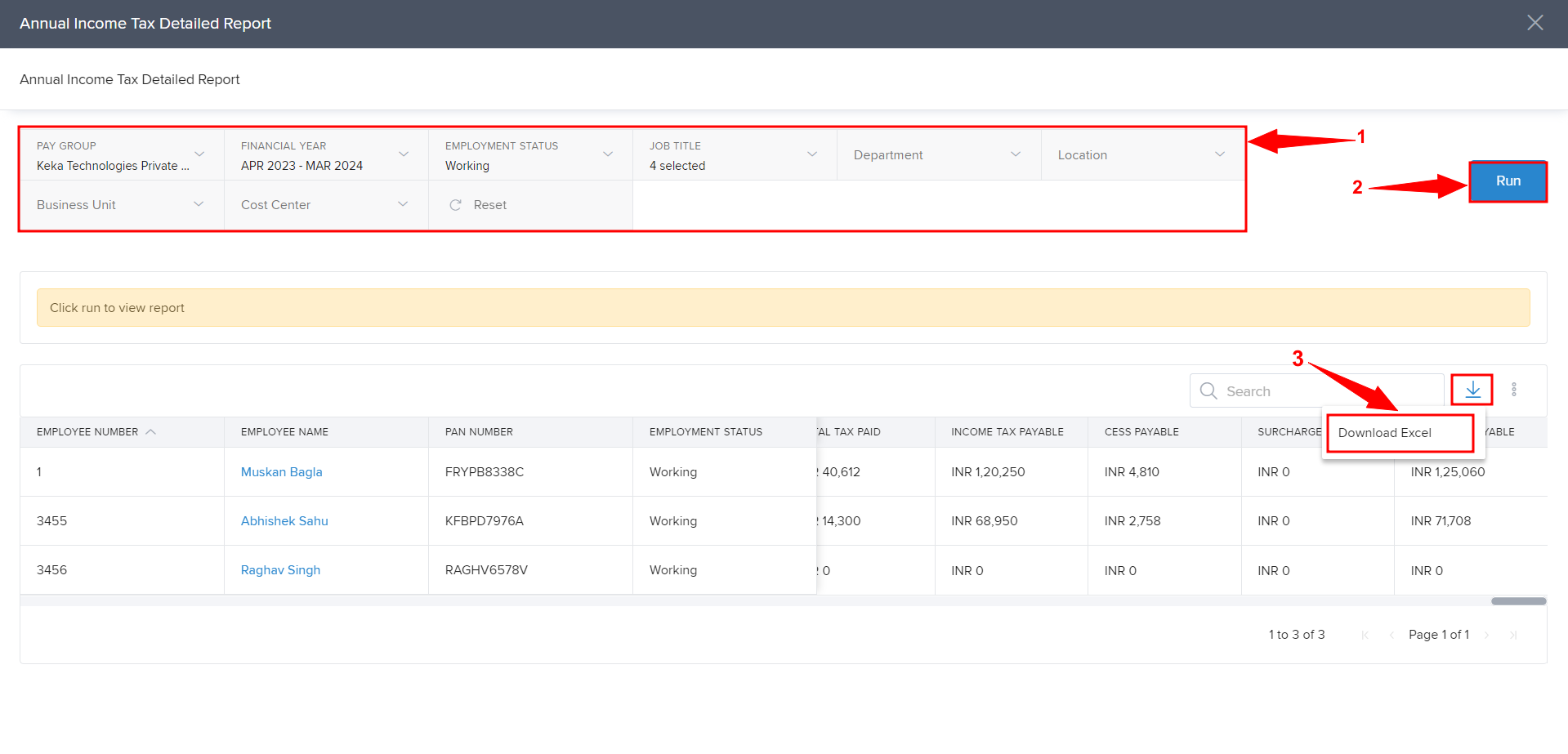

You'll be redirected to the Annual income tax detailed report

Where you need to select the Pay group (If there are more than one pay group configured), Financial year (Mandatory)(1), and also Employee status, Job title, Department, Location, Business Unit, and Cost center(1) as per your requirement and click on Run(2)

Once you click on Run, the report will be generated and you can Download(3) the report in the Excel format by clicking on the Download icon.

This is how you can check and download the Annual Income Tax Detailed Report.