-

Getting Started with Keka

-

Core HR

-

Payroll

-

Leave & Attendance

-

Performance

-

Keka Hire

-

Professional Services Automation

-

Expenses & Travel

-

HelpDesk

-

Billing Portal

-

Pricing Plans & Subscriptions

-

Videos

-

Manager Actions

-

Employee's User Guide

-

Keka Learn

-

IT Admin Articles

-

Troubleshooting Guides

-

Employee Engagement

-

API

-

Employee Experience

How do I add tax rates for billing in the timesheet?

When creating an invoice for a client, it is important to include the appropriate taxes based on their country. In Keka, you have the option to pre-define tax rates, allowing you to easily select them during the invoice generation process. This ensures that the taxes are calculated correctly according to the specified rates.

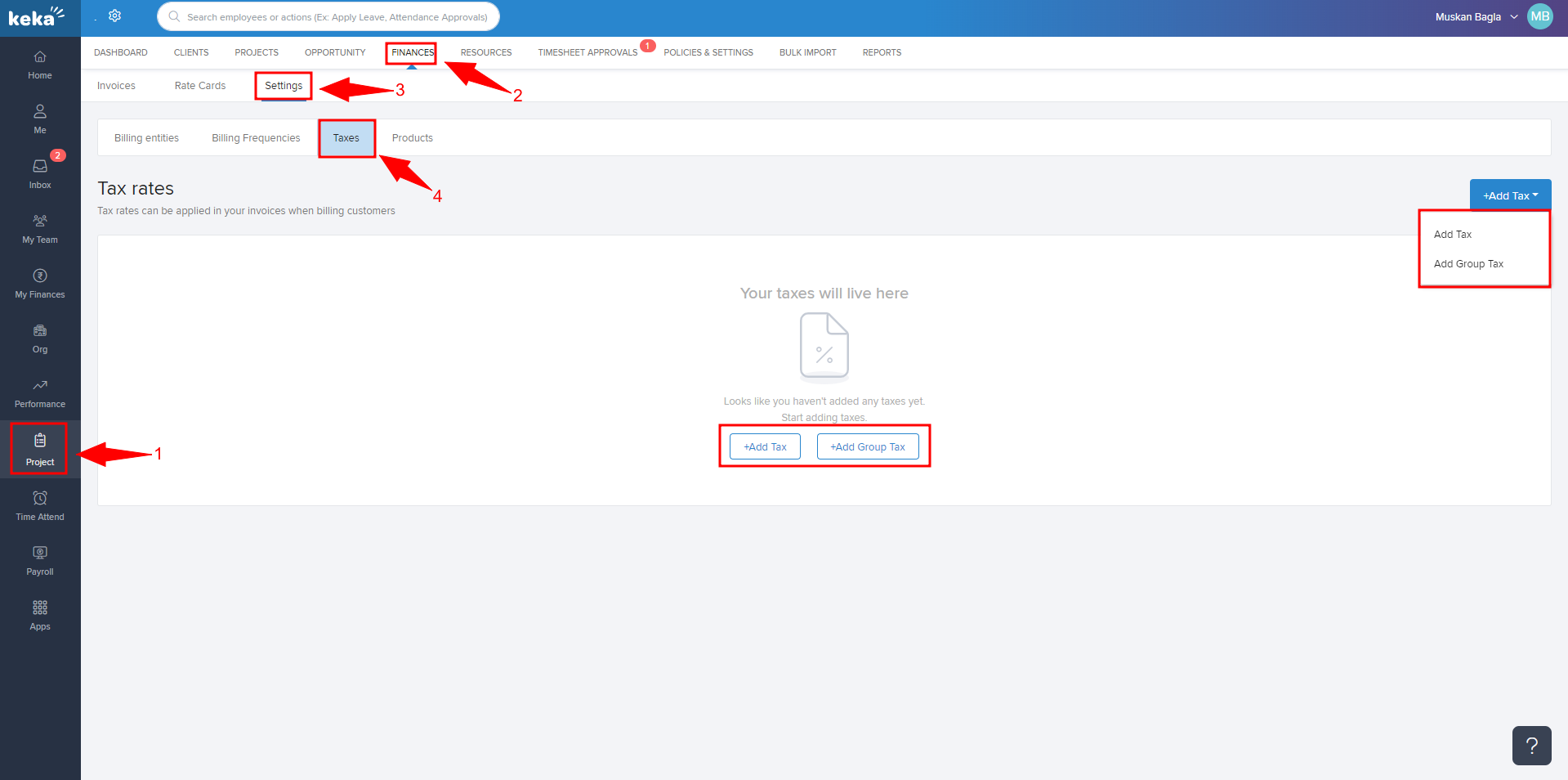

To set up tax rates for Timesheet Invoicing, navigate to the Project section (1) and select Finances (2). Within this section, locate the Settings tab (3) and choose Taxes (4). Here, you will find options to Add Tax or Add Group Tax. You can define group tax according to the legal entity, or you can create a general tax rate by selecting Add Tax.

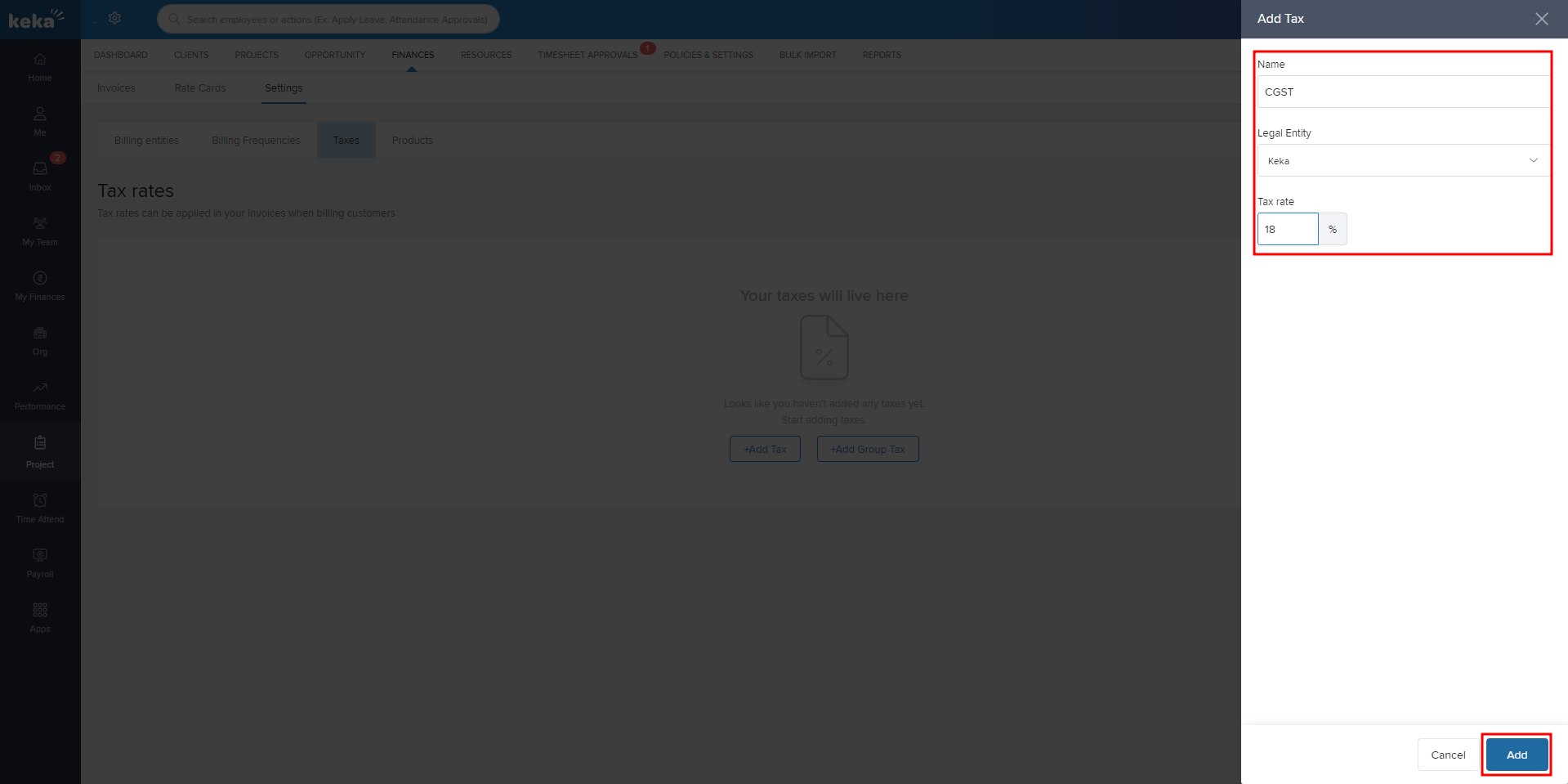

To add tax rates, click on "Add Tax" and fill in the required information in the provided window. Enter the name of the tax, select the corresponding legal entity, and specify the tax rate. After completing these details, click "Add" to save your changes.

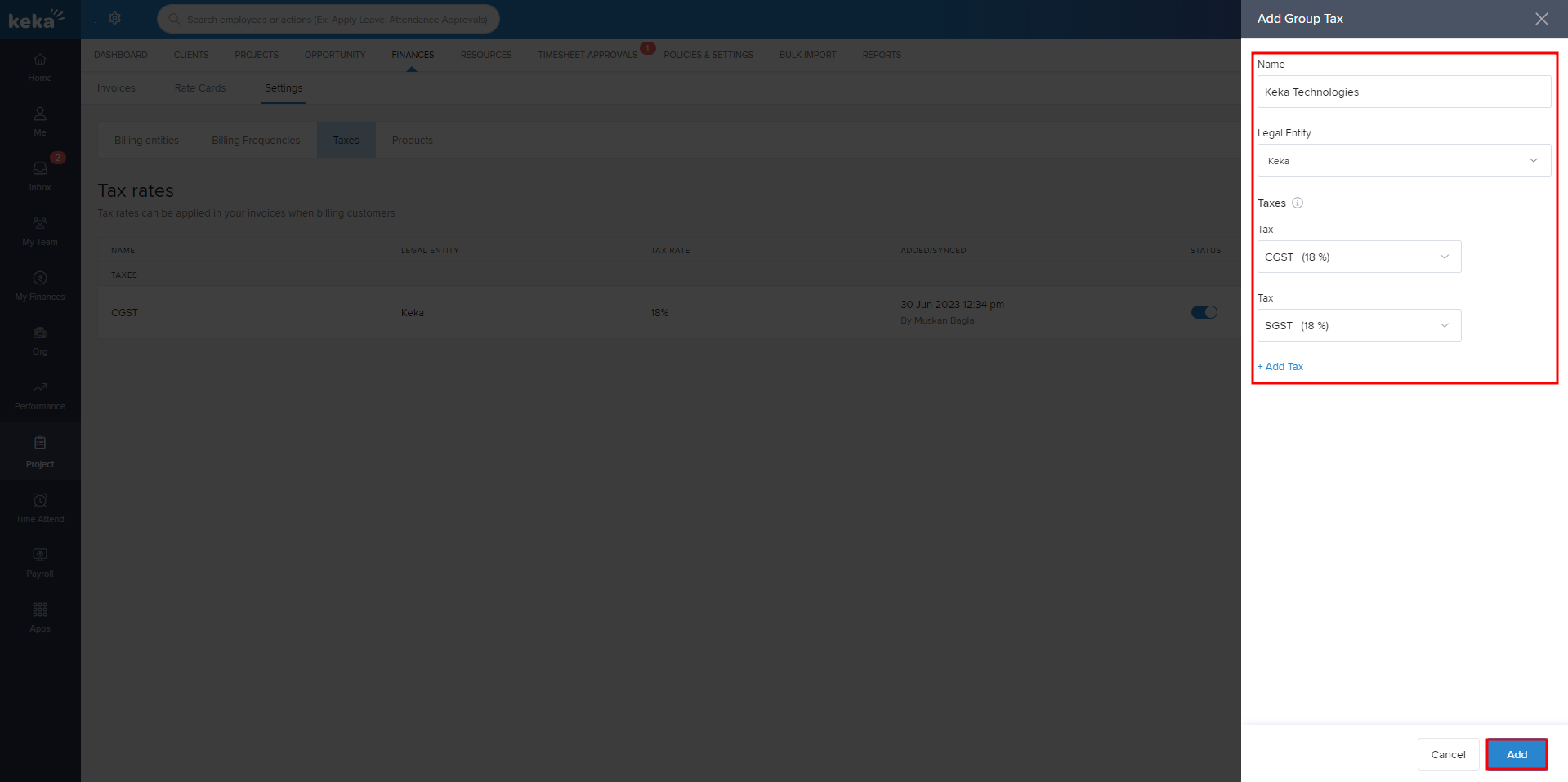

If you wish to add a Group Tax, click on the "Group Tax" option. In the subsequent window, provide the Tax Group Name, select the corresponding Legal Entity, and list the Taxes that fall under this group. After entering all necessary information, click "Add" to save your Group Tax settings.

We hope this explanation has clarified the process of adding tax rates in Keka for invoice generation. If you have any further questions or need additional assistance, please feel free to explore our other helpful articles or reach out to us directly!

For more details on how to add and adjust tax rates, please click here: Adding and modifying tax rates